If you’ve ever imagined diving into the world of trading with substantial capital but lack a hefty bankroll, prop firms could be exactly what you’ve been searching for.

These firms give traders the opportunity to tap into significant funds in exchange for a share of the profits—all without putting their own savings at risk.

Sounds appealing, doesn’t it? Let’s unravel the mechanics behind this.

How Do Prop Firms Operate?

In contrast to traditional trading, where you’d typically need to inject your own funds into a brokerage account, prop firms offer capital to those who can demonstrate their ability to manage risk and trade profitably.

The Challenge & Evaluation Process

Don’t expect online prop firms to hand over capital to just anyone. Traders must first prove their mettle by completing a challenge designed to show they can trade profitably while following specific risk guidelines. These include:

- Achieving a profit target (often 8-10%)

- Staying within a maximum daily loss threshold

- Avoiding reckless trading maneuvers

Upon passing, a trader gains access to a funded account, where they can utilize capital and enjoy a share of the profits—sometimes as high as 80-90%.

Why Do Traders Use Prop Firms?

Traders often lean towards prop firms instead of using their own money for several compelling reasons:

- Leverage – Access to a larger pool of capital than what’s personally available.

- Limited Risk – No personal funds on the line (aside from the challenge fee).

- Scaling Opportunities – Successful traders may see their account sizes grow over time.

However, it’s not always smooth sailing—many traders fail the challenge, and some firms have stringent rules making it hard to maintain an account.

How to Choose a Good Prop Firm

With a vast array of options, picking the right prop firm can be daunting, especially since not all are created equal.

Each trader has unique needs when considering the financial instruments they’d like to trade, the account size, or particular trading conditions.

When selecting a firm, consider:

- Reputation & Track Record – Steer clear of firms with dubious practices or a reputation for not paying traders.

- Realistic Rules – Ensure challenge requirements and payout structures are fair.

- Support & Resources – Some firms provide coaching, analytics, and trading tools to bolster trader success.

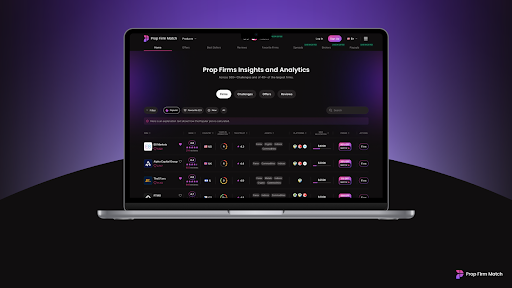

Platforms such as Prop Firm Match are designed to help you identify which firm aligns best with your trading goals and style.

This tool simplifies the process of selecting a prop firm, catering to traders of all experience levels. Let’s delve deeper into how it operates and why it’s groundbreaking for traders.

Why Should You Use the Prop Firm Match Comparison Tool?

Navigating the landscape of prop trading challenges and funded trader programs can be overwhelming.

This tool streamlines the journey by highlighting crucial aspects of a prop firm. Here’s how it helps:

- Tailored Recommendations – Customize the search to match your trading style and objectives.

- Comprehensive Filters – Refine your choices by key factors such as assets, account size, and profit targets.

- Side-by-Side Pricing Comparisons – Understand pricing transparency to get the best value.

- Regional Relevance – Locate firms that are accessible from your country.

- Time-Saving – Discover suitable prop firms tailored to your needs without extensive research.

How to Get the Best Out of the Prop Firm Match Comparison Tool

- Define Your Priorities: Identify what matters most to you—be it asset type, account size, or specific trading conditions.

- Apply Filters: Use the tool’s filters to narrow your search.

- Compare Firms: Evaluate firms side by side, considering pricing, reputation, and evaluation processes.

- Choose the Right Fit: Make a well-informed decision based on your preferences.

Final Thoughts

Prop firms present an exciting avenue for traders to access significant capital without bearing personal financial risk.

Yet, they’re no shortcut; achieving success still demands skill, discipline, and a robust strategy.

Thinking about exploring a prop firm? Head over to PropFirmMatch.com to discover the one that perfectly fits your needs.