So, inflation surprises us again! Numbers, predictions, and a whole lotta guesswork… let’s dive right in. The ONS – the place where stats mingle like a mismatched sock drawer – just dropped the latest info bomb on the UK’s inflation parade.

CPI? Yeah, that little monster dropped to 2.6% in March from its previous 2.8% in February. Who knew numbers could sound like a roller coaster ride, right? Everyone was betting on a 2.7% though… so that 2.6% snuck in like a cheeky plot twist. And get this, it’s the lowest we’ve seen since December. Merry March, maybe?

Here’s what the ONS report is blabbing about:

– Headline CPI does a slight shimmy down to 2.6% from 2.8%.

– Core inflation, pretending to ignore food, energy, alcohol, and tobacco (because sometimes they’re like that) tiptoed down to 3.4% from 3.5%.

– Services inflation? BAM, down to 4.7% from 5.0%—blink and you miss it.

– Slowdown’s got accomplices: recreation, culture, motor fuels, and our buddies at restaurants and hotels.

– Meanwhile, clothing and footwear prices decided, “up we go!” because why not?

In the words of Chief economist Grant Fitzner of ONS fame, “Inflation eased again in March,” which sounds like the kind of thing you’d say when your car sputters back to life on a cold morning. Fuel prices fell, food prices behaved, and petrol, whatever that is in your world—it dipped by 1.6 pence down to 137.5 pence per litre. I’ve no idea if that’s a good or bad thing in the crazy petrol world, but hey, it’s something.

Oh! Important because the overlords at the Bank of England are side-eyeing services inflation, or whatever they do, for those sneaky persistent price pressure vibes.

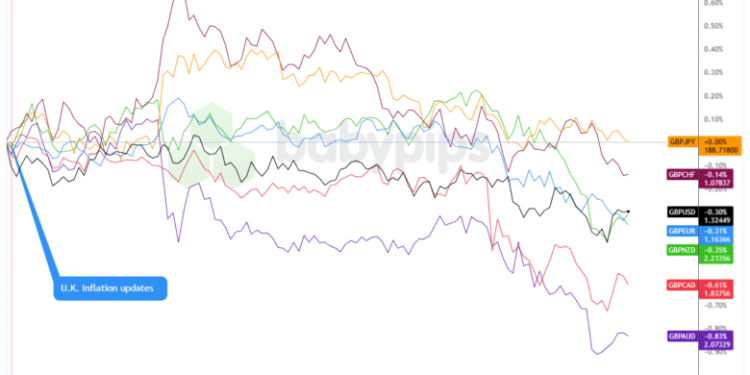

Okay, let’s chat about the market zone. The pound, our scrappy underdog, reacted like it just woke up from a nap. No big moves, just a sluggish ruckus against other big bad major currencies. A bit all over the place, really. Traders seemed like they were grabbing coffee waiting for the real show since they’re already obsessed with what’s coming in April. Apparently, everyone’s already betting on interest rate cuts, like some British Bake Off, but with finance.

Amidst all this chaos, the world went haywire too. More tariff tantrums! The US telling Nvidia it needs a license to send goodies to China, China asking for respect like a disappointed parent… and the pound, standing awkwardly, somehow caught up in this global soap opera.

Overall, the pretty laid-back market vibe probably reflects that while inflation’s on a bit of a downtrend, everyone’s perched on the April edge, where more price cap madness could be brewing. Stay tuned, or don’t — it’s all kicking off wherever you look. Cheers to the perpetual loop of economic juggling!