A few years back, fractional investing burst onto the scene as an innovative and exciting concept. The idea that virtually anyone could own a slice of something as prized as a Picasso for just a hundred dollars captured the imagination, especially of non-accredited investors.

However, it didn’t take long for the reality to set in as significant flaws began to emerge. Business models faltered, some companies couldn’t withstand the pressure and collapsed, leaving investors with a feeling of being left high and dry.

Today, we’re embarking on an in-depth exploration of the fractional investing landscape, looking at where it began, where it is now, and where it’s heading.

We’ll cover topics like:

- The strengths and weaknesses of the business model

- Its critical missteps

- Lessons the industry can glean

- What the future holds

We’ll also highlight insights from some forward-thinking founders who are revitalizing the sector.

Let’s take a closer look 👇

A special shoutout to Alan and Ryan from aShareX, Christian from hobbyDB, Joao from Lympid, and our co-founder Wyatt for their contributions to this issue.

Fractional Investing + Live Auctions: A New Approach

aShareX has stepped up as the first fractional auction platform for alternative investments. In today’s discussion, we address the hurdles investment platforms have historically faced, with arbitrary asset valuations leading the pack.

In resolution, aShareX bridges fractional ownership with the dynamism of auctions. This unique blend allows for market-driven asset valuations, potentially altering how investors access premium, alternative assets.

How it Works:

- Browse forthcoming auctions for unique assets like fine art, collectible cars, rare gemstones, and sports memorabilia.

- Place bids for fractional shares (or vie for full ownership), with the flexibility to dictate your entry price. Starting bids are as low as $1,000.

- Participate in annual shareholder votes to decide on asset sales, backed by impartial third-party appraisals.

Kickstart your journey with the premier fractional auction platform for alternative investments.

Get Started Here →

A Brief on Fractional Ownership

At a fundamental level, fractionalization allows shared ownership, enabling numerous investors to hold a slice of an asset.

Here’s the process:

- Companies identify owners of valuable assets and persuade them to list these on their platforms.

- They then securitize the asset using legal structures (such as LLCs) and divide it into shares.

- Investors can purchase these shares for prices starting from just a few dollars.

In theory, almost anything—from real estate to exquisite wine—can be securitized and fractionalized. These platforms generally manage the asset, facilitate trading, and oversee the distribution of any income generated while the asset is under their stewardship.

Understanding Fractional Investment Returns

The allure of fractional investment lies in its ability to offer access to high-value assets without needing full ownership. Typically, items like rare collectibles are out of reach for most, but fractional investment makes it possible to own a small part for a fraction of the full cost.

Returns come through dividends, asset sales, or even selling shares on a secondary market. The premise appears advantageous: original owners get to sell their assets, everyday investors gain investment opportunities, and the platforms earn their cut.

That’s the theory, but the reality presents challenges. While some problems have found solutions, others await resolution.

Monetizing Fractional Platforms

Platforms have diverse revenue streams. Management fees, for instance, cover administrative expenses and can be a percentage of the asset’s value, much like Fundrise’s 0.85% annual management fee. Other avenues include buyer’s premiums, sourcing fees, markups on asset prices, asset sale fees, and token sales.

The Fractionalization Journey: A Historical Glance

Fractional investing gained momentum with the 2012 JOBS Act in the U.S., which eased capital-raising restrictions and paved the way for Regulation A+, enabling businesses to attract investment from both accredited and non-accredited investors.

Initially, fractional investing took root in real estate—a logical choice due to real estate’s universal appeal and significant entry barriers. Companies like Fundrise, Crowdstreet, and Roofstock led the charge.

The Boom Years and Subsequent Challenges

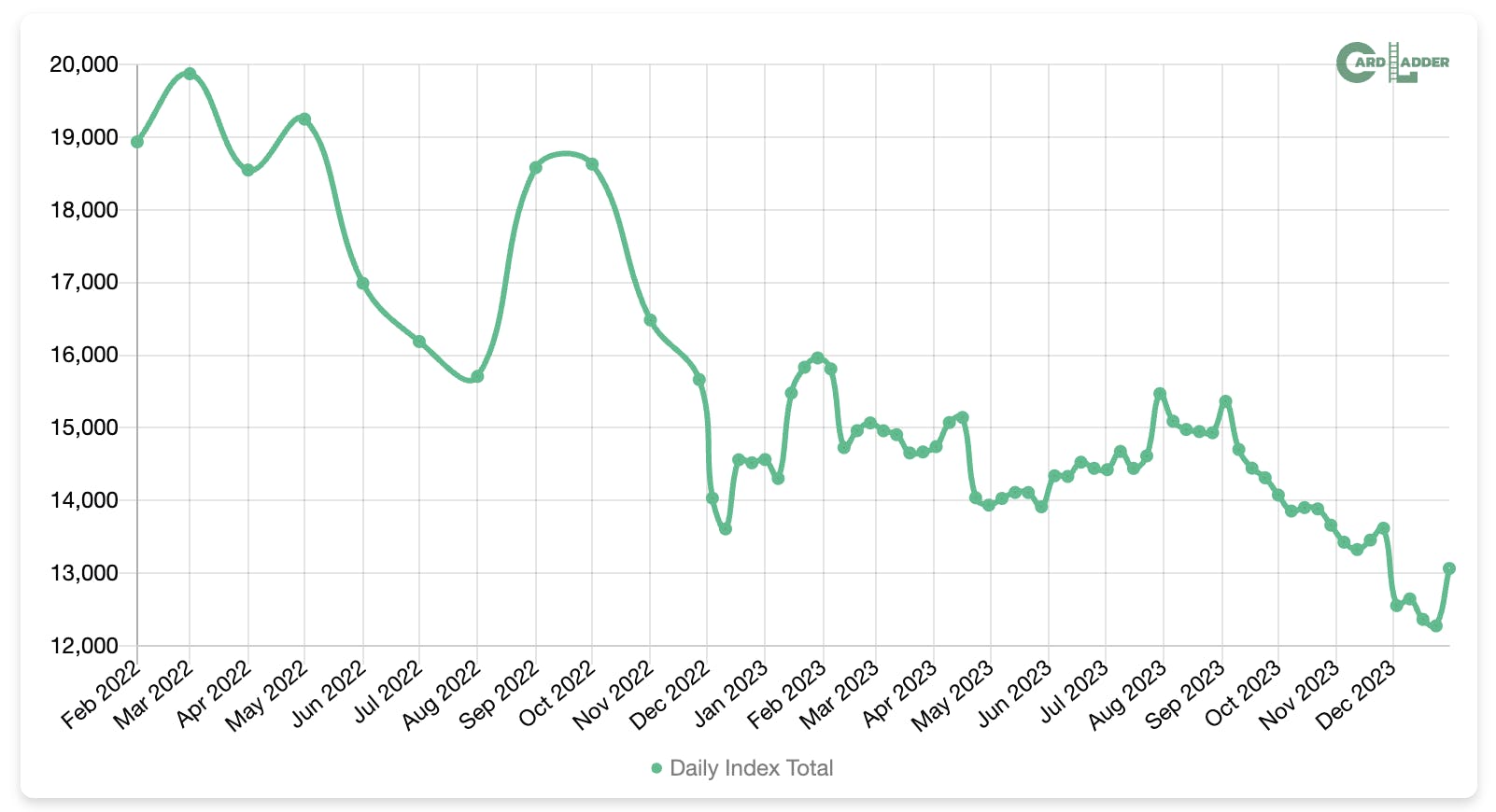

From 2017 to 2022, sparked by firms like Rally, the interest in fractional investing surged. Rally’s innovative approach, which fractionalized assets like classic cars and sports memorabilia, was noteworthy. However, external factors such as pandemic-driven conditions and the NFT craze fueled this rise.

Yet, the landscape shifted around 2022-2023, with a series of challenges arising. Notable instances include acquisitions like Otis by Public.com, the liquidation issues at Collectable, marketplace shutdowns like Dibbs, and business pivots such as those seen with Mythic Markets.

Why Fractional Markets Have Struggled

Let’s dissect the issues plaguing these markets:

- High Interest Rates: As expected, increased rates deterred spending and investment in riskier assets, pushing investors toward stable options.

- Overinflated Valuations: Exorbitant asset markups have long plagued this domain, diminishing investor returns. The example of Lofty.ai, where a property was overpriced by 40%, underscores this.

- Liquidity Woes: Many platforms lack active secondary markets, essential for providing liquidity to investors.

- Lack of Control: Investors often find themselves with limited agency over the destiny of their holdings.

- Administration Costs: The cumbersome, costly process of complying with regulation like Reg A+ poses significant hurdles.

- Platform Reliability: Recent platform failures have made investors wary of new ventures.

The Path Ahead: What’s Next for Fractional Investments?

While the old methodologies may not be fundamentally flawed, they certainly require refinement. Progress hinges on learning from past missteps.

- Liquidity is Key: Effective secondary markets and even involvement of market makers can rejuvenate platforms.

- Prioritize Quality: High-caliber, high-value assets make a better fit for fractional offerings, ensuring there’s substance to shine through the process.

- Embrace Global Opportunities: As legislation like Europe’s ECSP and MiCA evolve, they promise wider, international applicability.

- Explore Blockchain: Although nascent, blockchain technology may offer solutions through its potential for seamless asset tokenization, increasing liquidity and transparency.

Despite setbacks, the future of fractional ownership holds promise if innovation continues to be at the forefront of industry efforts. The original vision of democratizing access to premium assets remains achievable, provided we remain vigilant and adaptable. 🥧

That’s a wrap for today. Your thoughts are welcome, we read every response.

Until next time, Stefan.

Disclosures:

This edition was crafted by Stefan von Imhof with insights from Alan Snyder, Ryan Johnston, Christian Braun, Joao Lages, and Wyatt Cavalier.

This issue was sponsored by aShareX.

Neither Alts nor Altea maintains any vested interests in the companies discussed herein.

This article includes no affiliate links.