Last week was a rough one for the markets. Anyone paying attention could see that. The news about the U.S. slapping tariffs on all foreign goods made everything nosedive.

Let’s break it down:

- These new tariffs are the biggest tax hike since 1968.

- They’re predicted to push inflation up by 1% to 1.5%.

- It’s going to cost the average family an extra $3,585.

Given all this, it’s no surprise that the markets reacted the way they did.

Now, even if Washington’s best and brightest had come up with a smart tariff plan (and yes, I know that sounds like a contradiction), the market probably would have still taken a hit. But maybe it wouldn’t have been the gut-punch we saw.

In my opinion, the market was reacting not just to the economic hurt these tariffs are likely to cause, but also to how recklessly they were put together. Calculating the tariff rates between nations is complicated because different goods have different tariffs. Instead of working through the math to figure out what each country charges, the U.S. came up with a formula that, frankly, makes no sense.

Here’s a look at the formula:

Let’s say a company exports $50 billion to the U.S. and imports $25 billion. The tariff rate would be 50%. That’s because 50 minus 25, divided by 25, equals one. Multiply that by ½, and you get 0.5, or 50%.

Even if the other country didn’t have any tariffs on American goods, importers (and, ultimately, consumers) in the U.S. would still be hit with a 50% tariff.

That’s just plain illogical.

It feels like policy makers dusted off their high school math skills the night before the big paper was due and plugged numbers into ChatGPT for a formula.

As if that weren’t enough, tariffs were even slapped on territories with zero population.

No wonder the market lost confidence in the administration’s ability to boost the economy.

Still, I think the markets will bounce back, and here’s why.

We’re talking about President Trump here, a guy who tends to get what he wants. Taiwan is already considering dropping tariffs against the U.S., and just before the April announcement, Israel did away with tariffs on American goods.

If other countries join in and things start to cool down, we could see a strong market rally.

Plus, we know he can change his mind. With public and market backlash mounting, there’s a chance he might pivot. In fact, just yesterday, the market jumped for about 15 minutes on a rumor that he’s mulling over a 90-day tariff pause.

And let’s not forget how bearish investor sentiment is right now. That could very well mean a bottom is near.

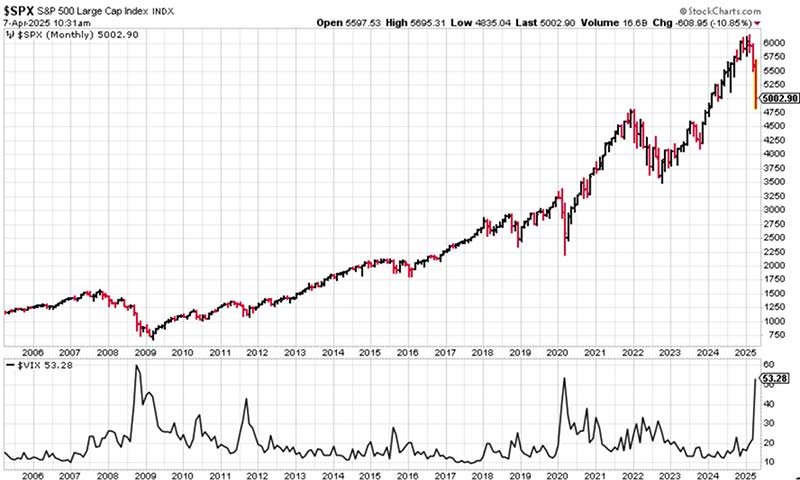

The VIX, which tracks volatility, hit an 18-month peak of 60. When the VIX is over 40, it usually signals panic is in the air.

Check this out: A 20-year chart of the S&P 500 at the top and the VIX at the bottom. Notice each time the VIX spiked, the S&P 500 saw solid gains afterward. Spikes in the VIX often pinpoint the bottom, like in 2008/9, 2011, 2015, 2020, and 2022.

Volatile, panicky times are often the moments to dive into the stock market because most of the selling pressure has already been exhausted.

Bear markets, especially ones that hit as fast as this one, are tough. But when they pass, they often become prime opportunities to boost stock portfolios.

Sure, there might be a little more turbulence ahead, but I think we’re getting close to the bottom.

So hang in there.