In recent developments, the open interest in Dogecoin has experienced a notable decline. This pattern is reflected across other memecoins like Shiba Inu and a few more.

Glassnode, a well-regarded analytics firm, recently highlighted trends related to open interest for various memecoins. Open interest, in this context, means the total number of active positions in a particular asset on all derivatives exchanges.

Let’s start by examining Dogecoin first. The graph below illustrates the seven-day moving average of Dogecoin’s open interest, the pioneer memecoin:

Back in December, Dogecoin’s open interest was at a solid $3.5 billion. However, there’s been a sharp decline, bringing it down to only $1.49 billion. This marks a substantial decrease of about 58.4%.

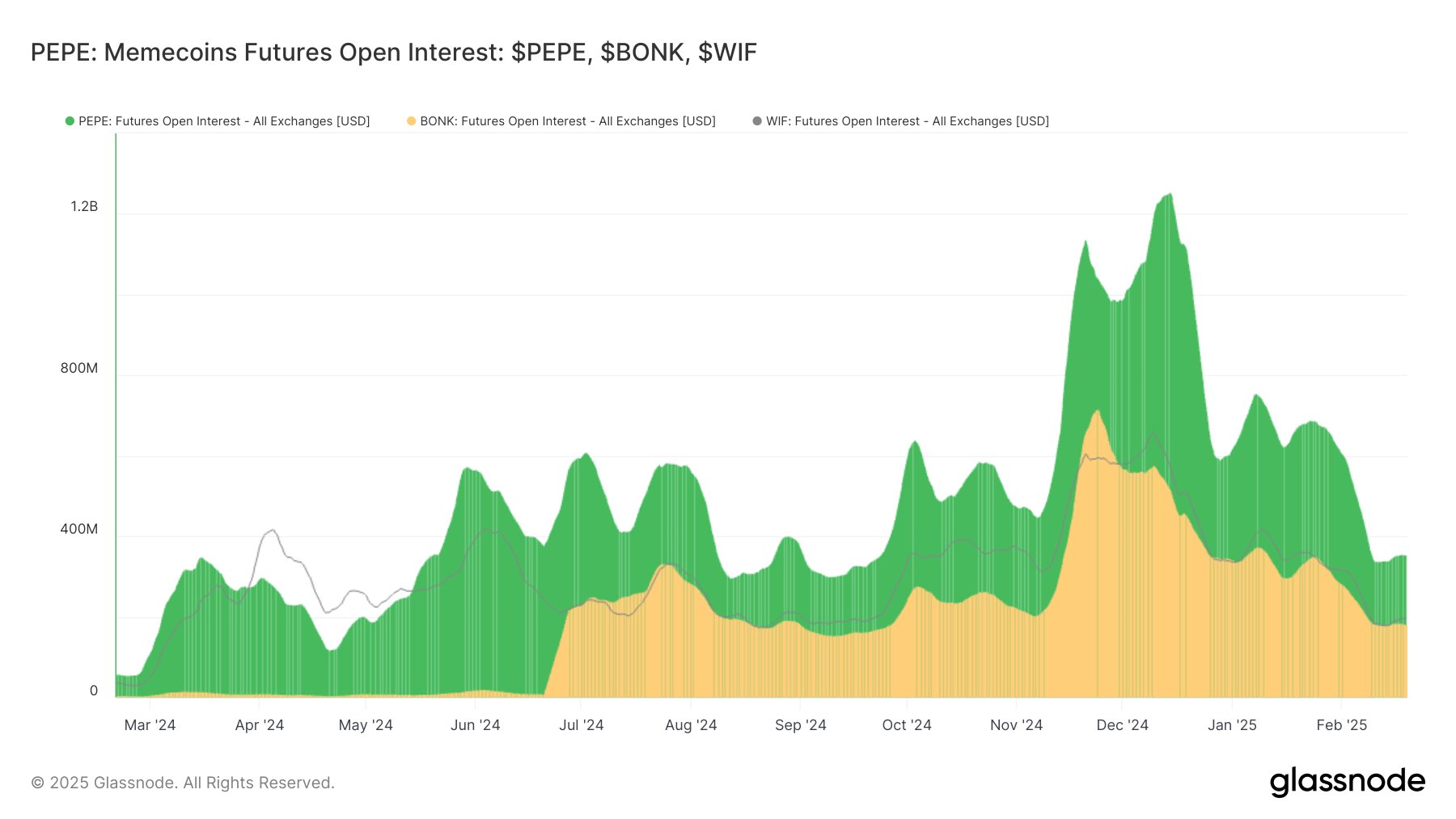

Dogecoin isn’t the only one facing these shifts; a second chart from Glassnode highlights similar trends in other memecoins.

Looking at Pepe (PEPE), Bonk (BONK), and dogwifhat (WIF), we can see they have experienced even steeper drops in open interest than Dogecoin, with declines exceeding 69% in recent months.

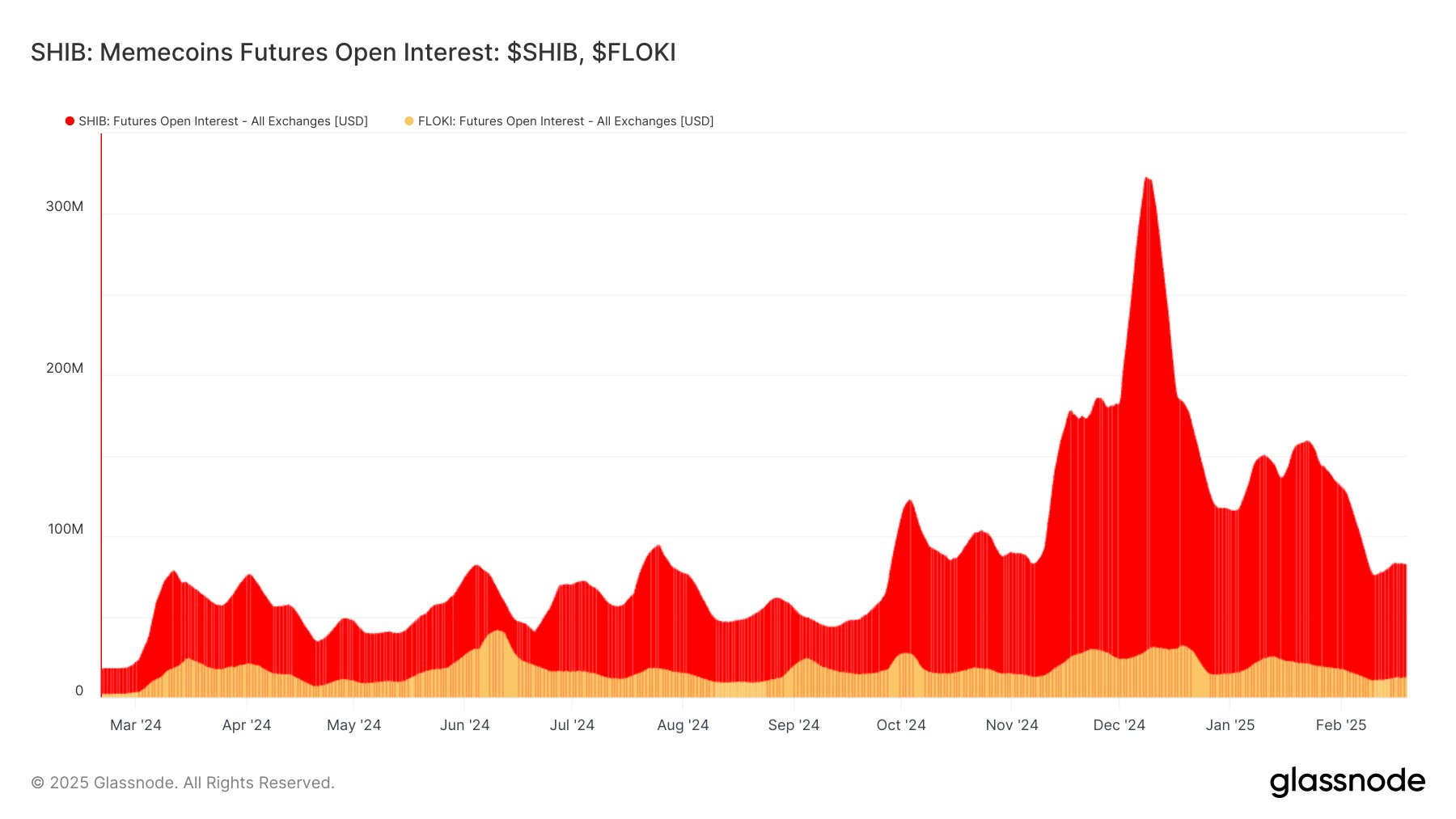

Similarly, Shiba Inu (SHIB) and Floki (FLOKI) show comparable patterns, registering reductions of 74% and 69%, respectively.

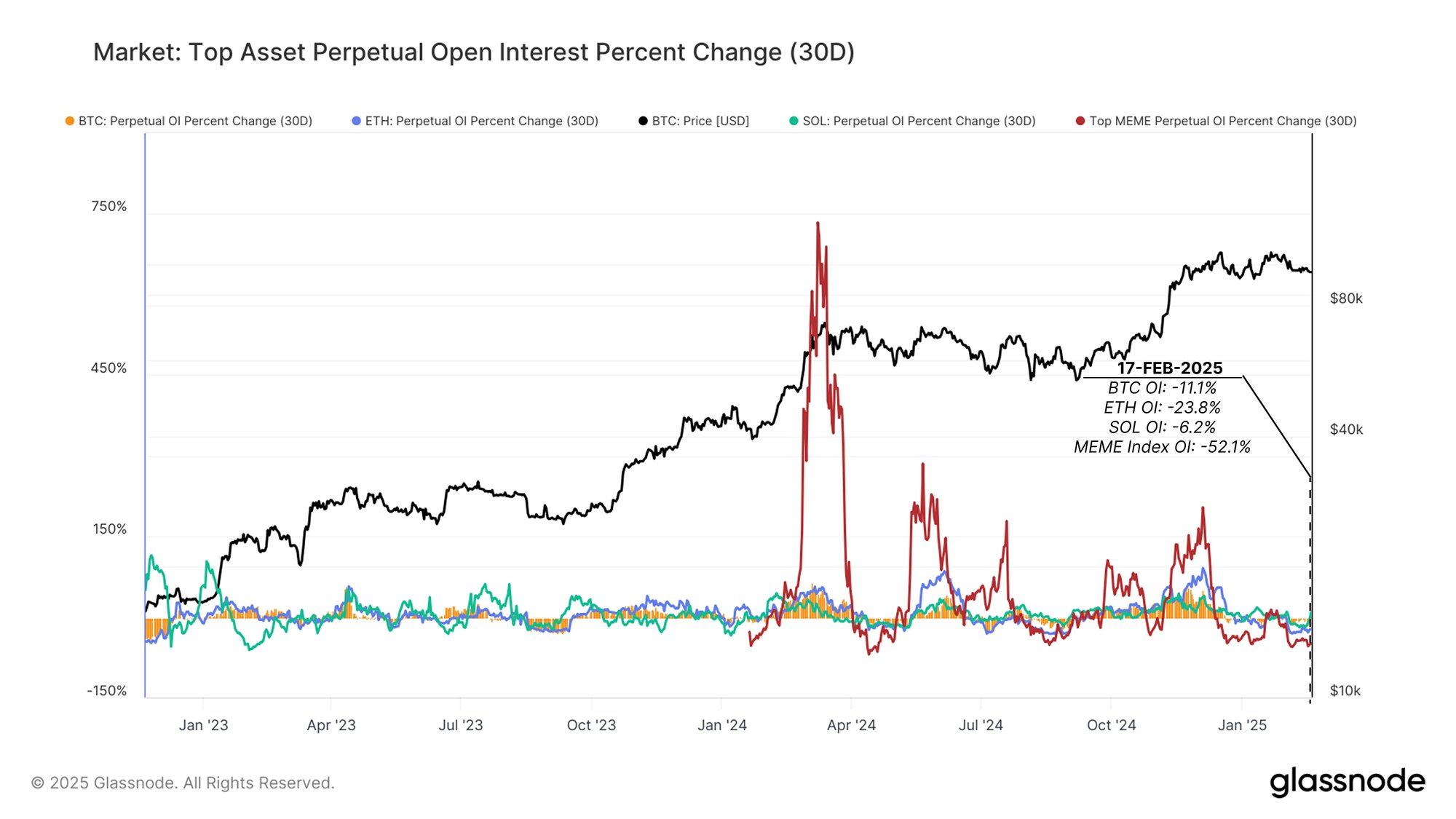

Despite the overall slump in speculative trading for memecoins, other segments of the crypto universe have shown different behaviors.

Glassnode has shared another chart depicting how open interest has shifted among meme assets versus leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL):

It’s clear from this graph that Bitcoin, Ethereum, and Solana witnessed a more modest decline of 11%, 23%, and 6%, respectively—much less severe than the overall 52% nosedive seen in the memecoin sector.

Switching gears to price movements, Dogecoin has been relatively stable over the past weeks, maintaining a steady price point around $0.25.