Over the past week, on-chain data has revealed that Bitcoin’s exchange netflow has consistently remained in the negative, suggesting that whales are in accumulation mode.

Bitcoin’s Exchange Netflow Trends

According to a recent post by market intelligence platform IntoTheBlock, there’s been a notable trend in Bitcoin’s Exchange Netflow. This metric is an on-chain indicator that tracks the net volume of Bitcoin moving in and out of wallets tied to centralized exchanges.

When this measure is positive, it indicates a higher number of deposits into exchanges. Typically, investors move their Bitcoins to exchanges primarily for selling, which can exert downward pressure on the cryptocurrency’s price.

Conversely, a negative netflow suggests that outflows from exchanges are surpassing inflows. This often means investors are opting to hold their coins in personal storage, which can be seen as a bullish signal for Bitcoin’s price.

Here’s a look at the data shared by the analytics firm, highlighting the recent trend in Bitcoin’s Exchange Netflow over the past week:

As shown in the chart above, Bitcoin’s Exchange Netflow has remained below zero in the last week. This pattern indicates a consistent net withdrawal by investors from exchanges, even amidst recent price downturns, implying that whale entities retain their confidence in Bitcoin. If this accumulation trend holds steady, Bitcoin might see a positive price shift.

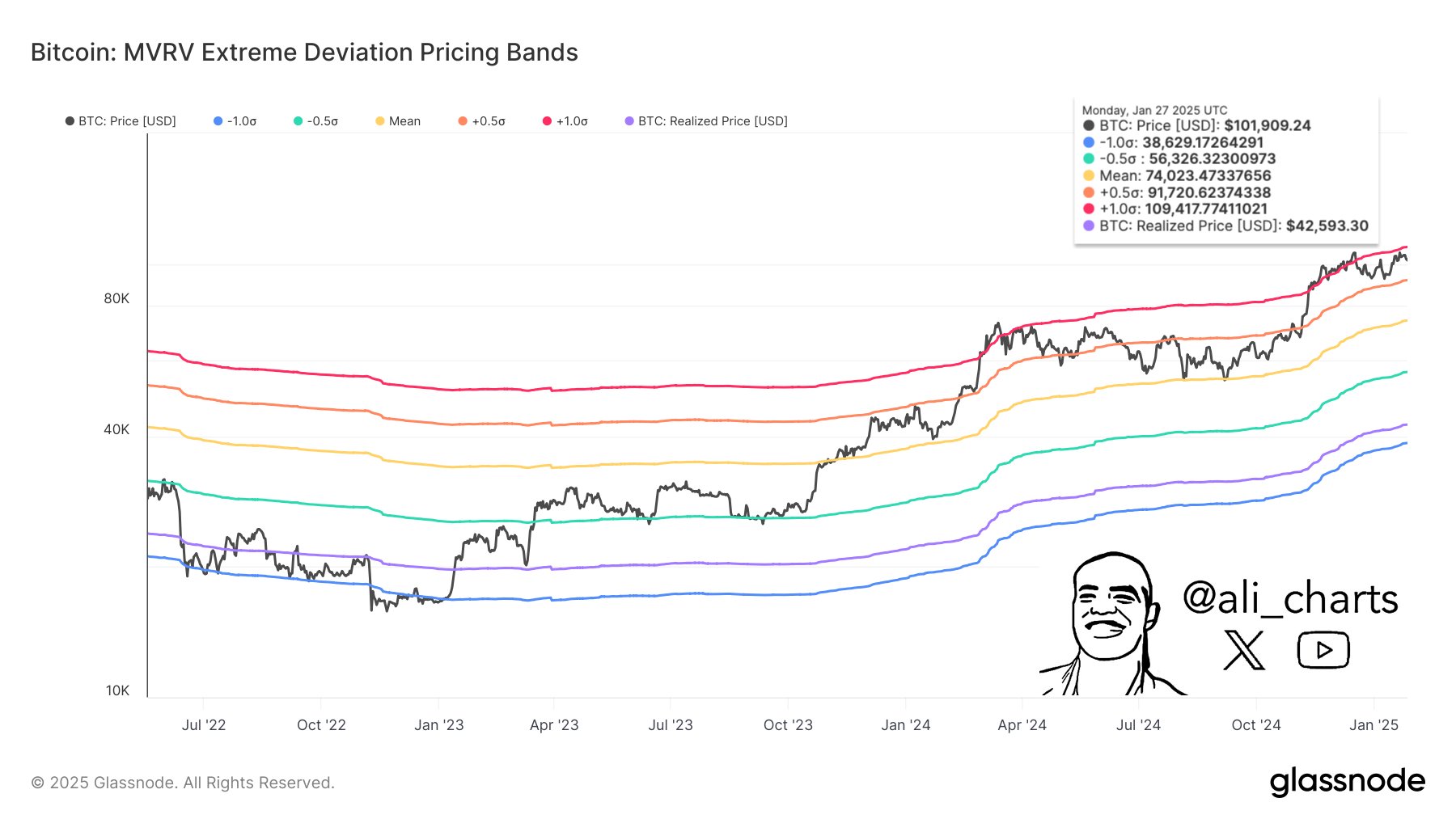

Moreover, Bitcoin recently experienced a price correction after hitting resistance at the top level of the Market Value to Realized Value (MVRV) Extreme Deviation Pricing Bands, as noted by analyst Ali Martinez in a post on the X platform.

This pricing model relies on the MVRV Ratio, which assesses investor profitability. When profits are excessively high, it may trigger mass sell-offs, potentially marking a peak in the asset. The model’s upper pricing band indicates where this peak is most probable.

According to Martinez,

Bitcoin (BTC) faced rejection at the upper red pricing band at $109,400. Without reclaiming this level, the focus shifts to the next significant support at the orange MVRV pricing band, currently around $91,700.

Current Bitcoin Price

As it stands, Bitcoin is trading around $102,400, reflecting a 2% decline in the past week.

It appears that Bitcoin’s price has dropped in recent days.

Featured imagery sourced from Dall-E, IntoTheBlock.com, Glassnode.com, and chart data from TradingView.com.