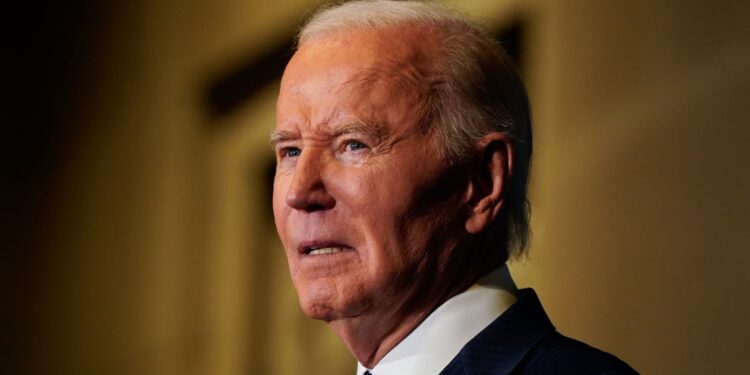

President Joe Biden recently addressed the Tribal Nations Summit at the Department of the Interior in Washington, D.C., emphasizing the importance of partnerships with Native American communities. However, back in the world of finance, the administration made a significant decision: it pulled back on two ambitious proposals for student loan forgiveness. These plans were designed to allow the U.S. Department of Education’s secretary to cancel student loans for groups of borrowers, including those who have struggled with repayments for years and those facing financial difficulty.

The potential impact of these policies was considerable, with millions of Americans standing to benefit from reduced or erased student debts. Just before the transition to a new presidential administration, the Education Department announced the withdrawal of these plans by publishing notices in the Federal Register. The reason cited was “operational challenges” in rolling out the proposals. Instead, the department decided to focus its resources on helping at-risk borrowers transition back to loan repayment.

Despite inquiries, the department did not issue a comment on its decision. On the financial front, reducing debt remains a top goal for Americans in 2025, alongside increased 401(k) contributions and identifying key “housing hot spots.”

Higher education expert Mark Kantrowitz commented that the Biden administration likely anticipated resistance from President Trump, who has vocally criticized student loan forgiveness efforts. Trump’s comments have been harsh, deeming Biden’s efforts as “vile” and legally questionable.

This latest development in Biden’s student loan strategy follows the Supreme Court’s rejection of his initial major loan forgiveness attempt in mid-2023. The move has understandably disappointed consumer advocates like Persis Yu from the Student Borrower Protection Center, who voiced concerns about the missed opportunity for economic mobility that debt relief could have provided.

Despite the setback, student loan forgiveness options remain accessible for many borrowers. Elaine Rubin from Edvisors, which offers guidance on navigating college costs, reminded the public of existing programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF). PSLF enables certain not-for-profit and government workers to have their loans forgiven after a decade of timely payments, while TLF provides up to $17,500 in forgiveness for teachers in low-income schools after five years of service.

In a recent announcement, the Biden administration revealed a further $4.28 billion in debt relief for 54,900 borrowers working in public service under the PSLF program. Many are concerned about the future of this program, which is legally protected and would require congressional action to dismantle.

For those seeking more information, resources like Studentaid.gov and The Institute of Student Loan Advisors offer guidance on available student loan forgiveness programs across the nation.