Last updated on November 22nd, 2024 by Bob Ciura

For those pursuing a strategy focused on dividend growth investing, the goal is often to rely on the income generated from their portfolio during retirement. By adhering to this strategy, investors might find a greater sense of financial security in their retirement years, as their investments can continue to generate income irrespective of the economy’s condition.

We believe it’s crucial for investors to focus on acquiring high-quality dividend stocks, especially those known as Dividend Aristocrats. These are companies that have consistently increased their dividends for at least 25 years in a row.

This esteemed group includes only 66 companies qualifying as Dividend Aristocrats.

We’ve compiled a list of these 66 Dividend Aristocrats, complete with key financial metrics like dividend yield and P/E ratios.

To access the comprehensive list of Dividend Aristocrats, follow the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global. The Dividend Aristocrats Index is owned and maintained by S&P Global. The information provided here and in the downloadable spreadsheet stems from Sure Dividend’s analyses and reviews of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources. It’s designed to help individual investors understand this ETF and the index it tracks better. It’s not official data from S&P Global. For official information, consult S&P Global directly.

Ideally, investors would receive consistent monthly income from their portfolio because expenses don’t vary much. However, many companies typically disburse dividends at the end of every quarter—typically March, June, September, and December.

This can create inconsistent cash flow, presenting challenges for those needing regular monthly income. Yet, it’s possible for investors to build a well-diversified portfolio of high-quality dividend stocks that can provide steady income throughout the year.

To address this, we’ve curated a model portfolio of 15 stocks. Each boasts at least nine years of dividend growth, with the average holding boasting a 25-year streak.

Stocks were chosen from multiple sectors, ensuring investors benefit from a diversified portfolio offering income every single month.

January, April, July, and October Payments

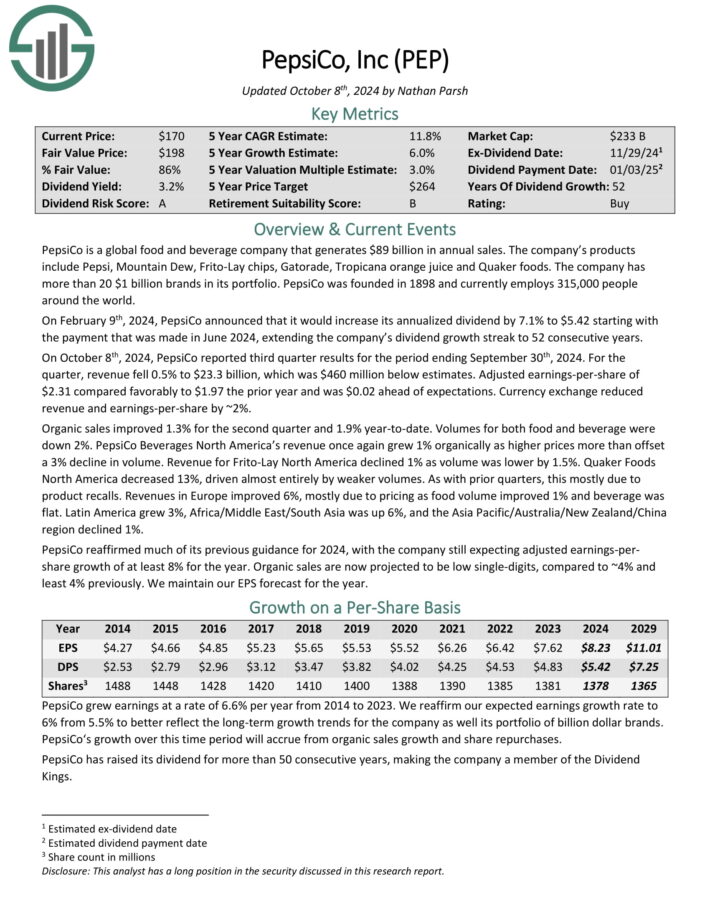

PepsiCo, Inc. (PEP)

PepsiCo is a well-known global food and beverage leader, registering $89 billion in annual sales. Its line-up includes famous brands like Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice, and Quaker foods.

The company’s revenue is approximately divided 60-40 between food and beverages, with a balanced geographic presence in the U.S. and internationally.

Source: Investor Presentation

PepsiCo released its third-quarter results for the period ending September 30th, 2024, on October 8th, 2024. Revenue saw a slight dip of 0.5% to $23.3 billion, missing estimates by $460 million.

Adjusted earnings-per-share came in at $2.31, an improvement from the $1.97 in the previous year, and exceeded predictions by $0.02. Revenue and earnings-per-share were negatively impacted by currency exchange, each by around 2%.

The company recorded organic sales growth of 1.3% for the second quarter and 1.9% year-to-date, though both food and beverage volumes were down 2%.

In North America, PepsiCo Beverages’ revenue grew organically by 1%, as increased prices balanced a decline in volume of 3%.

Download our latest Sure Analysis report on PEP (preview below):

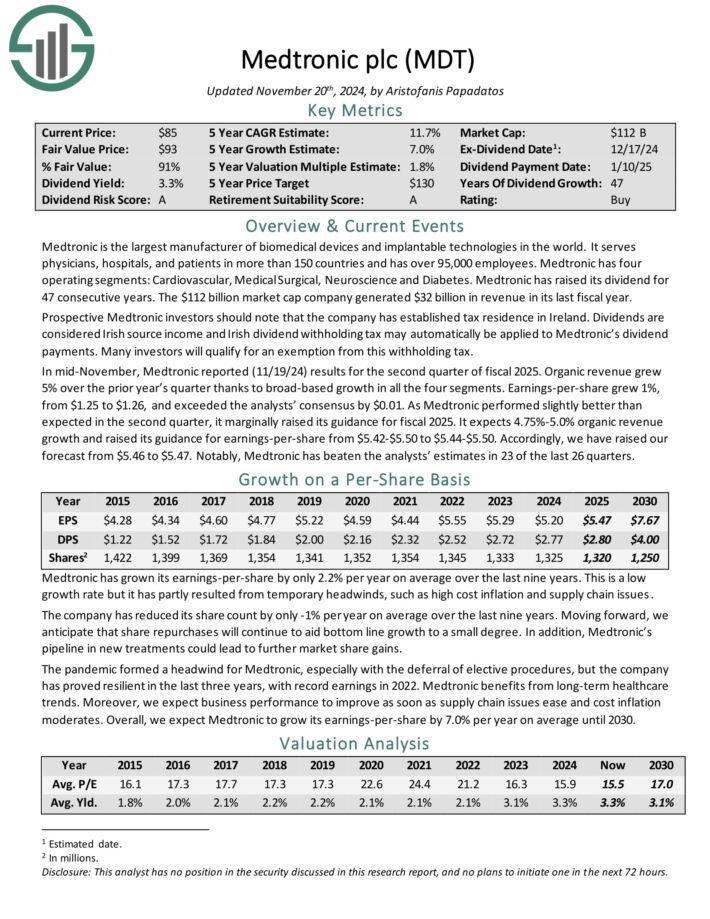

Medtronic plc (MDT)

With a presence in over 150 countries, Medtronic is the largest producer of biomedical devices and implantable technologies globally. It operates through segments like Cardiovascular, Medical Surgical, Neuroscience, and Diabetes.

The aging global population provides a growth opportunity for Medtronic, as the need for healthcare products and services rises. In the U.S., there’s a significant demographic of nearly 70 million Baby Boomers needing increasing medical care.

Medtronic shared its fiscal 2025 second-quarter results on November 19th, 2024. Organic revenue grew 5% year-over-year, propelled by broad growth across its segments. Earnings per share increased slightly to $1.26 from $1.25, surpassing analyst expectations by $0.01.

Thanks to its better-than-expected performance in the second quarter, Medtronic has slightly raised its fiscal 2025 guidance.

Download our latest Sure Analysis report on Medtronic plc (preview below):

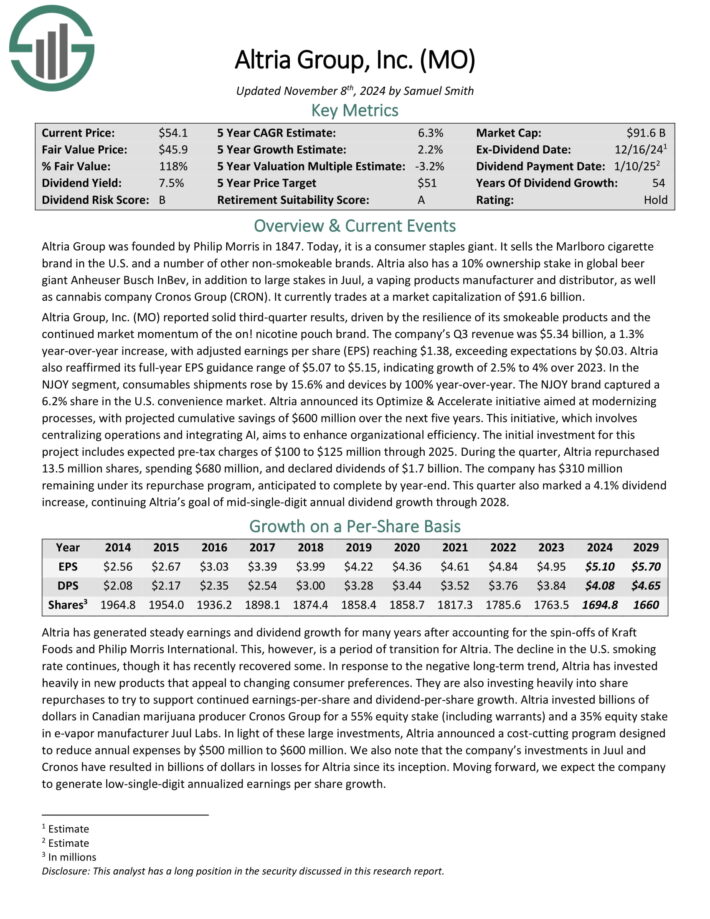

Philip Morris International (PM)

Emerging from a 2008 spin-off from Altria Group, Philip Morris is a major marketer of tobacco products internationally. Marlboro is its flagship brand despite declining tobacco use in the U.S. Philip Morris isn’t affected due to its focus outside the U.S.

The company reported its Q3 2024 results on October 22nd, showing an 8.4% increase in net revenue to $9.91 billion. Adjusted EPS went up by 14.4% year-over-year to $1.91, with an 18.0% increase in constant currency.

Overall shipment volumes increased 2.9%, with a notable rise in combustibles, stabilizing after several declining years.

Shipment volumes for cigarettes, heated tobacco, and oral products grew by 2.9%, 8.9%, and 22.2% respectively, aided significantly by acquiring Swedish Match.

Download our latest Sure Analysis report on Philip Morris International (preview below):

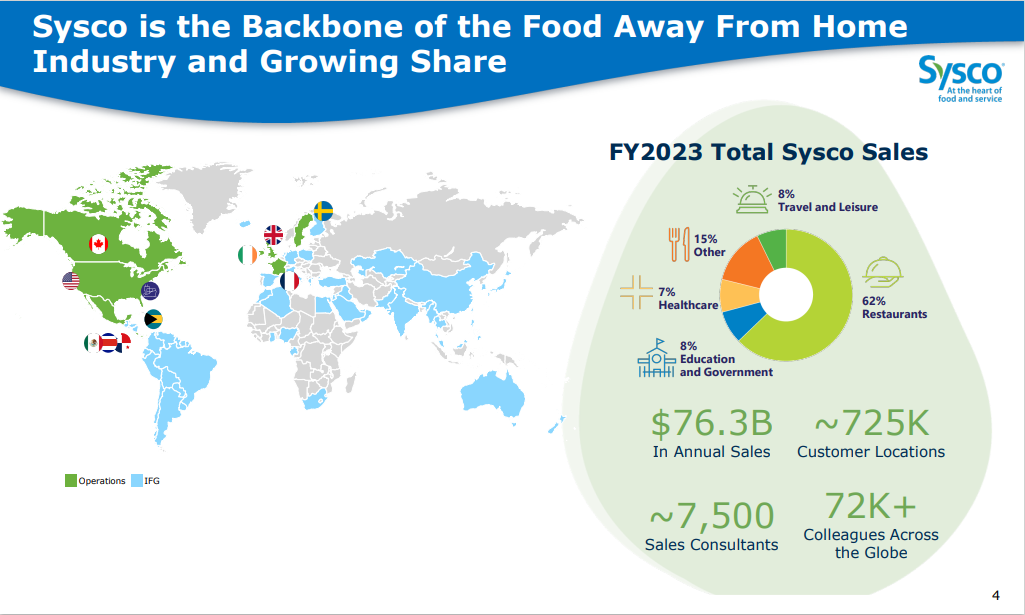

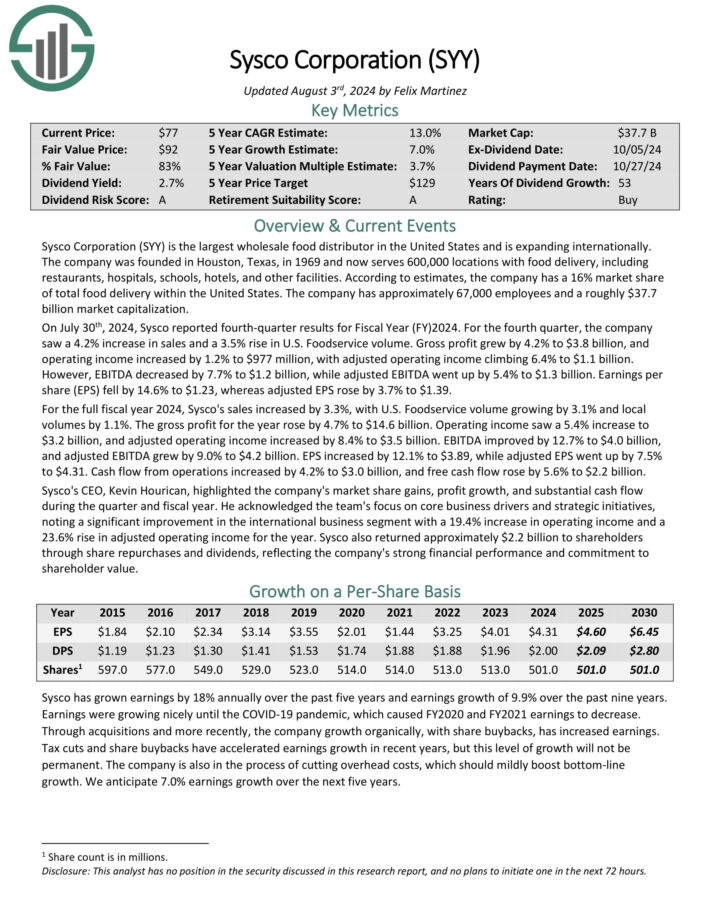

Sysco Corporation (SYY)

Sysco Corporation stands as the largest wholesale food distributor in the U.S., serving 600,000 locations including restaurants, hospitals, schools, hotels, and other institutions.

Source: Investor Presentation

On July 30th, 2024, Sysco shared its results for the fourth quarter of fiscal 2024, revealing a 4.2% increase in sales and a 3.5% upsurge in U.S. Foodservice volume.

The company posted a gross profit growth of 4.2% to $3.8 billion, while operating income increased by 1.2% to $977 million, with adjusted operating income climbing 6.4% to $1.1 billion.

EBITDA saw a 7.7% decline to $1.2 billion, while adjusted EBITDA rose by 5.4% to $1.3 billion. Earnings per share fell 14.6% to $1.23, in contrast, adjusted EPS increased by 3.7% to $1.39.

Download our latest Sure Analysis report on Sysco (preview below):

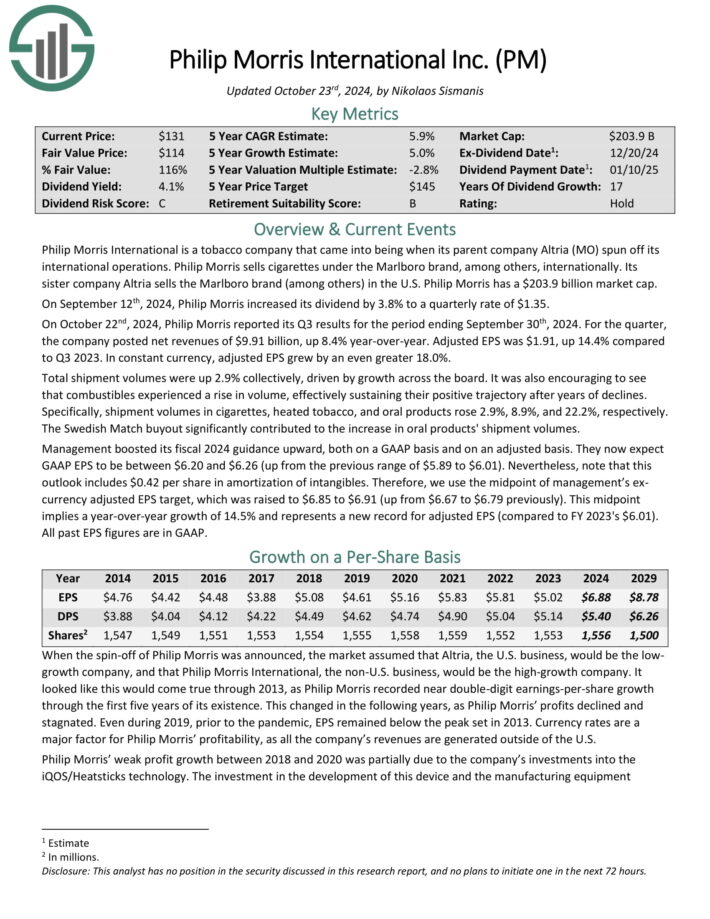

Altria Group (MO)

Founded by Philip Morris in 1847, Altria Group has emerged as a leading consumer staples company. While best known for its tobacco products, a noteworthy feature is its 10% stake in Anheuser-Busch InBev, a global beer giant.

Altria’s third-quarter results indicated robust performance driven by the resilience of its smokeable products and growing momentum for its on! nicotine pouch brand. The company’s revenue was $5.34 billion, up 1.3% from the previous year, with adjusted earnings per share reaching $1.38, exceeding expectations by $0.03.

The company reiterated its full-year EPS guidance range of $5.07 to $5.15, displaying a growth of 2.5% to 4% over 2023.

In the quarter, Altria repurchased 13.5 million shares with an expenditure of $680 million and declared $1.7 billion in dividends, leaving $310 million under its repurchase program anticipated to conclude by year-end.

Download our latest Sure Analysis report on Altria (preview below):

February, May, August, and November Payments

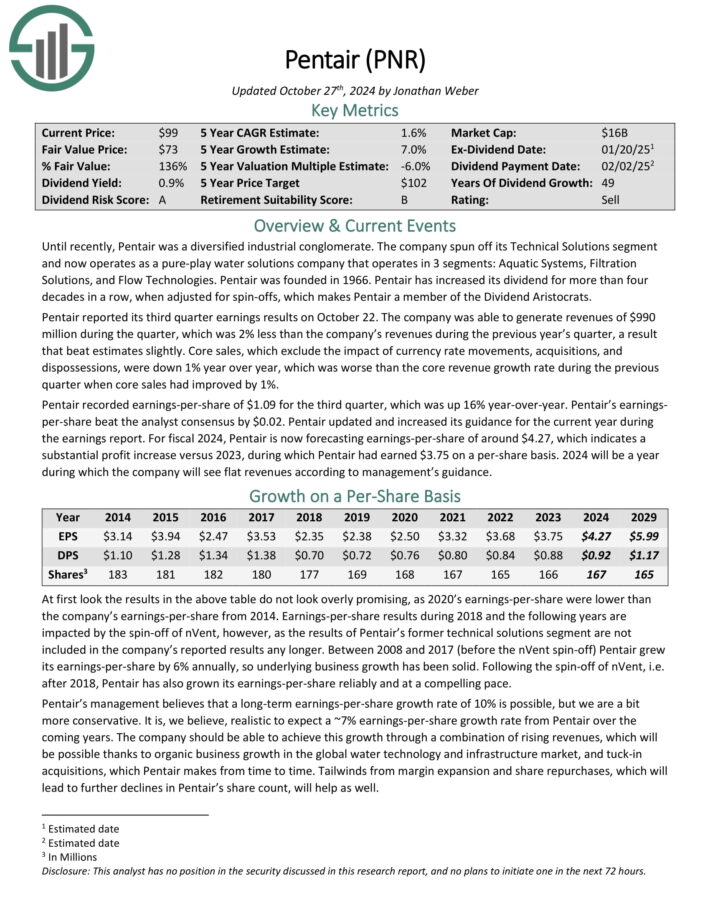

Pentair plc (PNR)

Pentair specializes in water solutions and operates through segments like Aquatic Systems, Filtration Solutions, and Flow Technologies since its inception in 1966. The company has been consistently raising its dividend for over 40 years when adjusted for spin-offs.

Pentair reported third-quarter earnings on October 22, showing $990 million in revenue, a 2% decline compared to the previous year. However, this was slightly better than estimates.

The company’s core sales, excluding currency rate movements and other factors, were down 1% year-over-year, a bit worse than the previous quarter where core sales had improved by 1%.

Pentair posted earnings-per-share of $1.09 for the quarter, a 16% increase year-over-year, beating analyst expectations by $0.02.

Download our latest Sure Analysis report on Pentair (preview below):

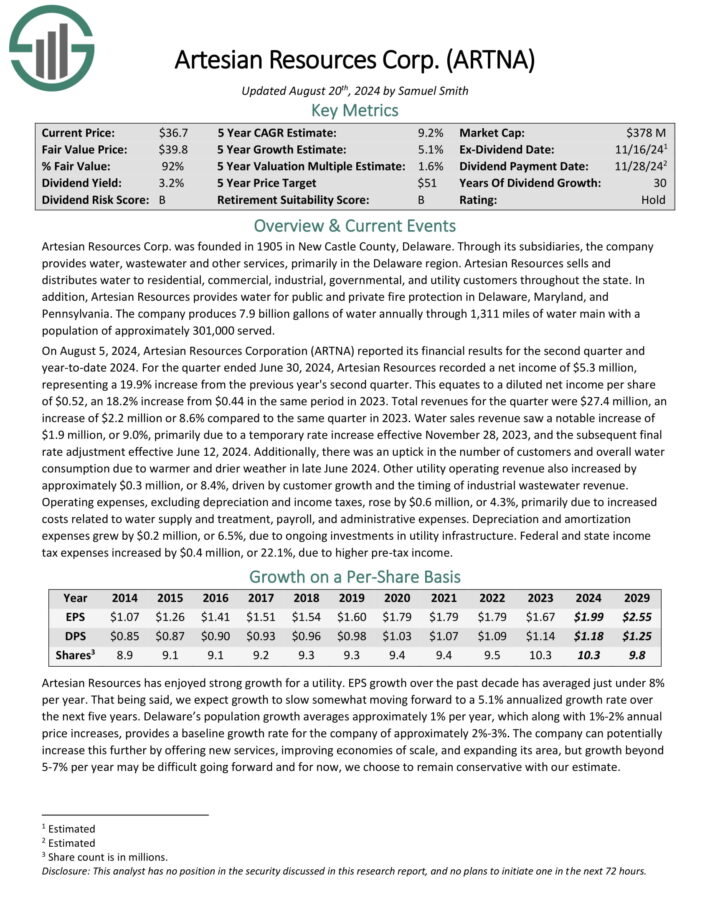

Artesian Resources (ARTNA)

Founded in 1905 in New Castle County, Delaware, Artesian Resources Corp. offers water, wastewater, and other services through its subsidiaries, primarily in Delaware.

Artesian Resources distributes water to a variety of customers, offers fire protection services, and produces 7.9 billion gallons of water annually through 1,311 miles of main pipes, catering to about 301,000 individuals.

On August 5th, 2024, Artesian Resources reported its second quarter and year-to-date 2024 financial results, recording a net income of $5.3 million, a 19.9% increase from the previous year’s second quarter.

This resulted in a diluted net income per share of $0.52, up 18.2% from $0.44 in the same period in 2023. Quarterly revenues were $27.4 million, an increase of $2.2 million or 8.6% from 2023’s same quarter.

Download our latest Sure Analysis report on Artesian Resources (preview below):

Westamerica Bancorp (WABC)

Westamerica Bancorporation is the holding company for Westamerica Bank, a regional bank with 79 branches across Northern and Central California, tracing its roots back to 1884. It offers various financial services and has roughly $325 million in annual revenues.

For the third quarter ending September 30th, 2024, Westamerica Bancorporation reported a 10.8% decline in revenue to $74.4 million but managed to exceed expectations by $3.6 million. GAAP earnings of $1.31 per share fell short of the previous year’s $1.33, yet exceeded forecasts by $0.07.

Total loans decreased by 8%, with commercial loans dipping by 10.1% and consumer loans shrinking by 22.1%. Interestingly, commercial real estate loans, forming the bulk of the portfolio, remained unchanged, while nonperforming loans fell by 25.8% to $919,000 year-over-year.

Download our latest Sure Analysis report on Westamerica Bancorp (preview below):

Matthews International (MATW)

Matthews International Corporation caters to global markets with its offerings in brand solutions, memorialization products, and industrial technologies through three diversified business segments.

The SGK Brand Solutions segment provides brand development services, while the Memorialization segment supplies products like caskets and cremation equipment. The Industrial Technologies segment, though smaller, focuses on manufacturing and distributing marking, coding, and automation technologies.

In its third-quarter report on August 1st, 2024, Matthews International presented a 9.3% sales decline, mainly due to a 30% shrinkage in its Industrial Technologies segment.

Adjusted earnings arrived at $0.56 per share, a 24% drop from the previous year’s $0.74. Additionally, the company’s net debt leverage ratio increased sequentially from 3.6 to 3.8.

Download our latest Sure Analysis report on Matthews International (preview below):

Procter & Gamble Co. (PG)

Procter & Gamble is a stalwart in the consumer staples field, boasting a history dating back to the 1830s. It’s renowned for its iconic brands like Pampers, Charmin, Gillette, Old Spice, Oral-B, and Head & Shoulders.

In recent years, Procter & Gamble has streamlined its offerings, reducing its number of brands dramatically from 170 to 65.

On October 18th, 2024, Procter & Gamble revealed its first quarter results for fiscal 2025. Sales slightly declined by 1%, though organic sales rose 2% year-over-year, attributed to 1% price hikes and volume growth. Core earnings per share increased to $1.93 from $1.83, surpassing consensus estimates by $0.03.

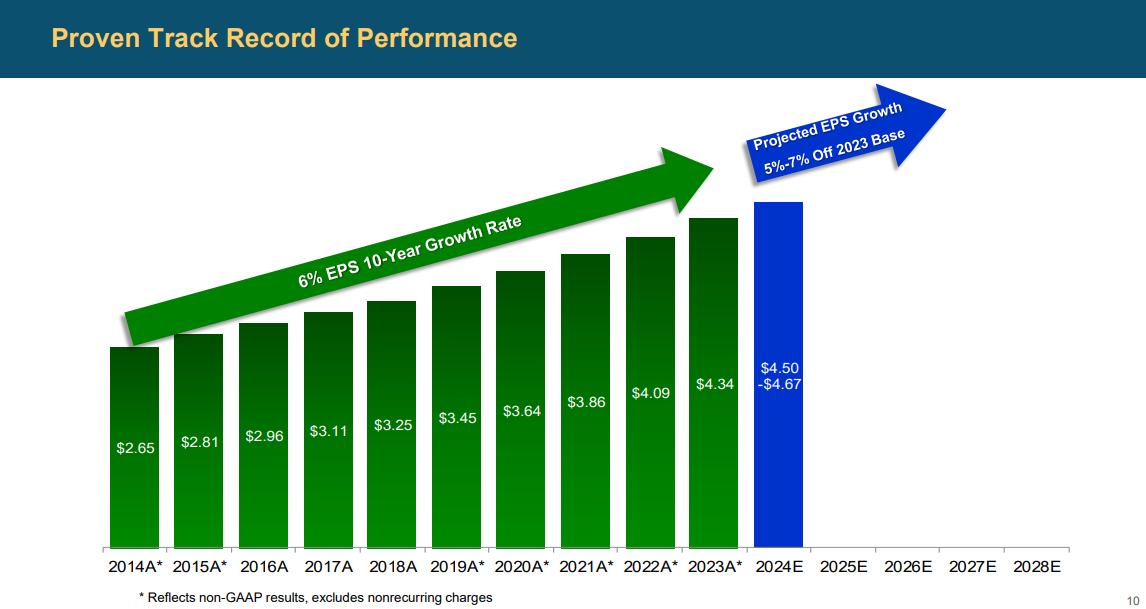

Despite resilient sales due to price increases, the pace of these hikes has noticeably slowed recently. However, Procter & Gamble has maintained its guidance for organic sales growth of 3%-5% and earnings-per-share growth of 5%-7% for the fiscal year 2025.

Download our latest Sure Analysis report on Procter & Gamble (preview below):

March, June, September, and December Payments

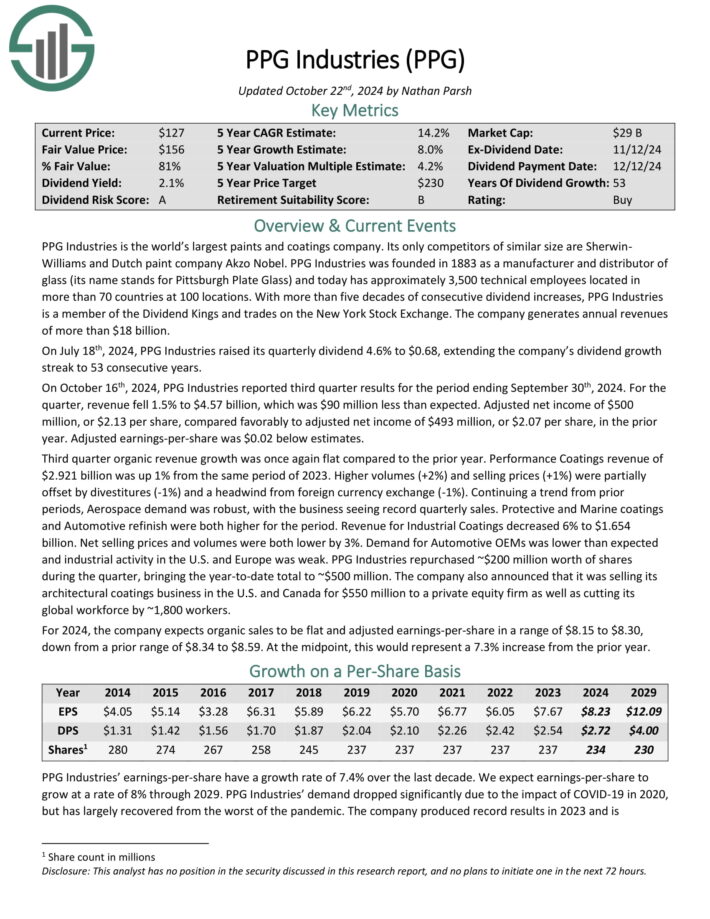

PPG Industries (PPG)

PPG Industries holds the title as the largest paints and coatings company worldwide, competing primarily with Sherwin-Williams and Akzo Nobel.

On October 16th, 2024, they disclosed their third-quarter results for the period ending September 30th, and the figures revealed a 1.5% decline in revenue to $4.57 billion, $90 million short of expectations.

Their annual revenue hovers around $18.2 billion.

Source: Investor Presentation

Adjusted net income was $500 million, or $2.13 per share, up from the prior year’s $493 million, or $2.07 per share. However, adjusted earnings per share lagged by $0.02 below forecasts.

Organic revenue growth remained flat in the third quarter compared to the previous year. Performance Coatings revenue increased by 1% to $2.921 billion compared to 2023, driven by higher volumes and increased selling prices, offset partially by divestitures and currency exchange headwinds.

Download our latest Sure Analysis report on PPG (preview below):

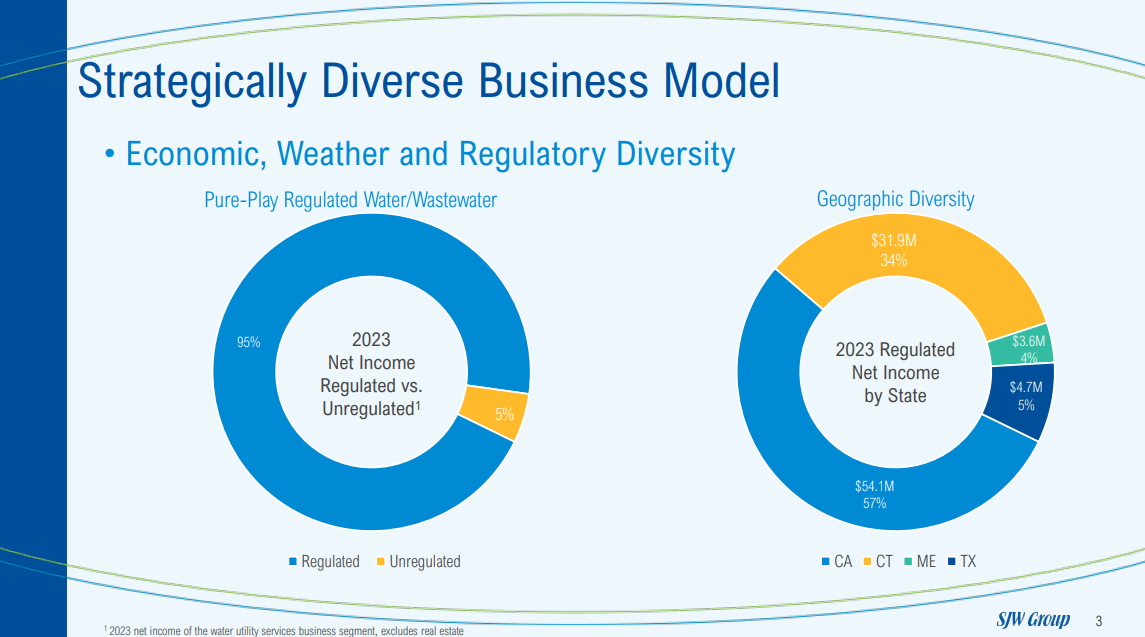

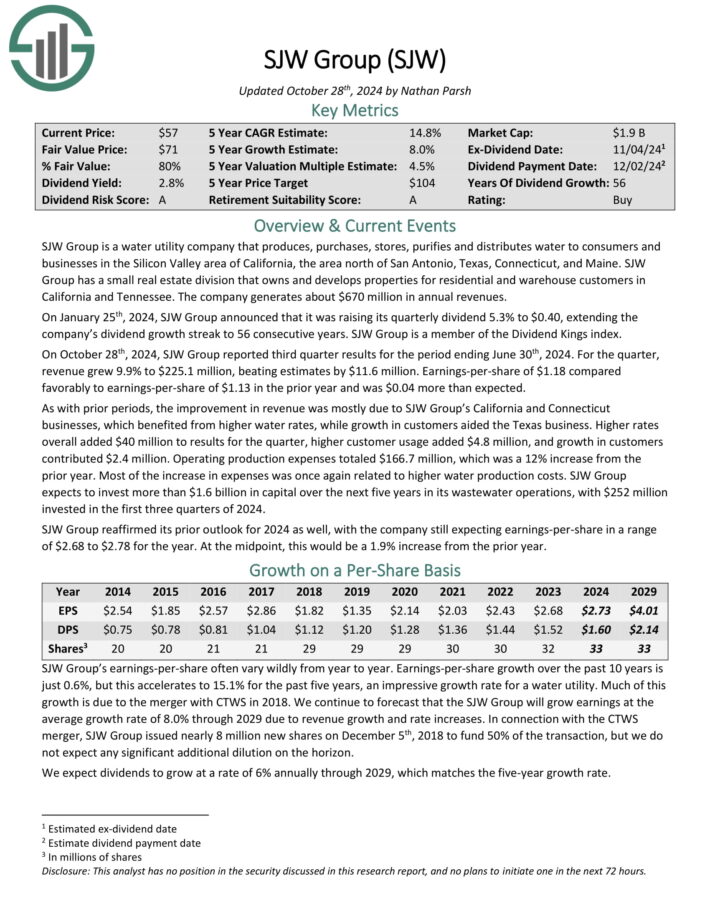

SJW Group (SJW)

SJW Group is a water utility that provides services such as producing, storing, purifying, and distributing water across parts of California, Texas, Connecticut, and Maine.

The company has a minor real estate arm that manages properties for residential and commercial clients in California and Tennessee, drawing about $670 million in yearly revenue.

Source: Investor Presentation

On October 28th, 2024, SJW Group announced its third-quarter results, marking a 9.9% revenue increase to $225.1 million, surpassing estimates by $11.6 million. The earnings per share reached $1.18, up from the previous year’s $1.13, exceeding expectations by $0.04.

Revenue enhancements stemmed from SJW’s operations in California and Connecticut, benefiting from higher water rates, bolstered by customer growth in Texas.

Download our latest Sure Analysis report on SJW (preview below):

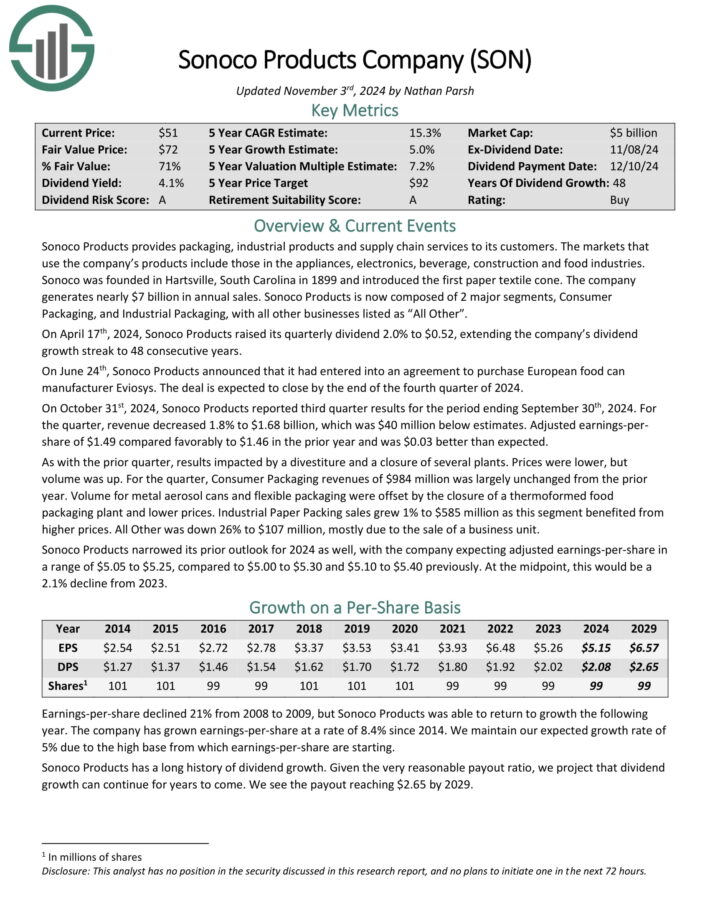

Sonoco Products Company (SON)

Sonoco Products offers packaging, industrial products, and supply chain management to markets like appliances, electronics, beverage, construction, and food industries.

Generating nearly $7 billion annually, Sonoco operates two primary segments: Consumer Packaging and Industrial Packaging, with other businesses under “All Other.”

Source: Investor Presentation

For the third quarter ending September 30th, 2024, Sonoco reported a 1.8% drop in revenue to $1.68 billion, $40 million shy of estimates.

Adjusted earnings per share of $1.49 topped the prior year’s $1.46 and surpassed projections by $0.03.

As seen in previous quarters, the results were affected by divestitures and the closure of several plants. While prices saw declines, volumes rose.

The Consumer Packaging division reported $984 million in revenue, nearly matching last year’s performance.

Download our latest Sure Analysis report on Sonoco (preview below):

Eversource Energy (ES)

Eversource Energy operates as a diversified holding company with subsidiaries providing regulated electric, gas, and water utility services in the U.S. Northeast.

With more than 4 million customers, Eversource grew through acquisitions like NStar’s utilities, Aquarion, and Columbia Gas.

They have consistently delivered growth to shareholders.

Source: Investor Presentation

As of November 4th, 2024, Eversource Energy reported a net loss of $(118.1) million for the third quarter of 2024, a significant drop from their $339.7 million earnings in the prior year, mainly attributable to exiting offshore wind ventures.

The loss per share was $(0.33), contrary to the previous year’s earnings per share of $0.97. Nonetheless, the Electric Transmission segment’s earnings increased to $174.9 million, up from $160.3 million the year before, due primarily to expanded investments.

Download our latest Sure Analysis report on Eversource Energy (preview below):

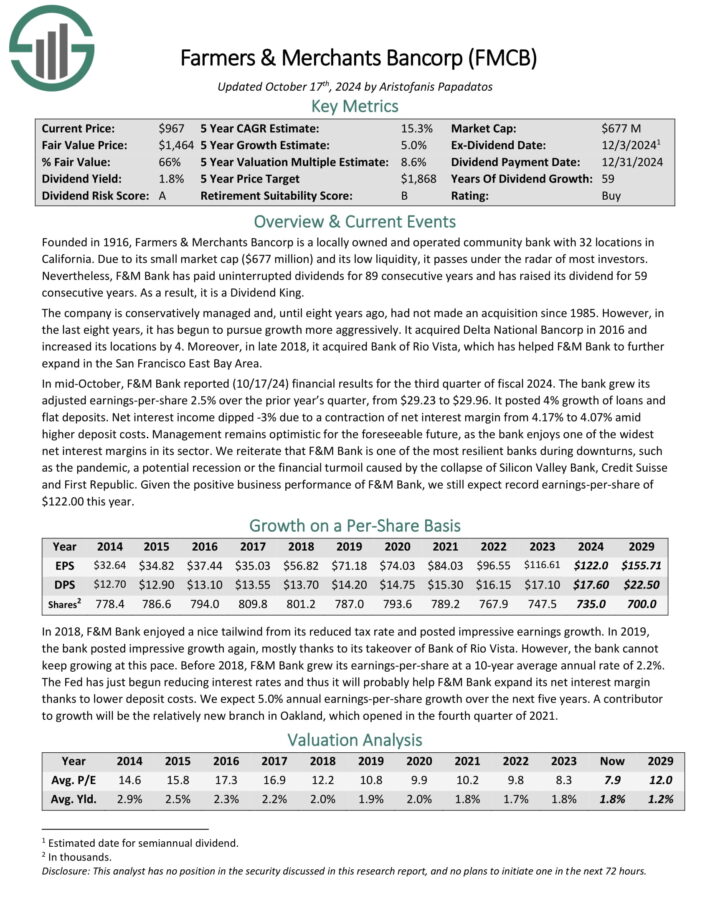

Farmers & Merchants Bancorp (FMCB)

Farmers & Merchants Bancorp operates as a local community bank with 32 branches in California, often overlooked due to its small market capitalization and trading volume.

They have maintained 88 years of uninterrupted dividends and 59 years of consecutive dividend increases.

In mid-October, F&M Bank noted a 2.5% increase in adjusted earnings per share, moving from $29.23 to $29.96 in the third quarter of fiscal 2024.

The bank reported 4% loan growth and stable deposits. Net interest income declined by 3% due to net interest margin narrowing from 4.17% to 4.07% amidst rising deposit costs.

Enjoying prudent management, F&M Bank maintains a conservative capital ratio, currently at 14.95%, achieving the “well-capitalized” regulatory classification. Their credit quality remains robust, with minimal non-performing loans and leases.

Download our latest Sure Analysis report on Farmers & Merchants Bancorp (preview below):

Final Thoughts

Investors looking for steady monthly income can create a portfolio containing high-quality stocks with long-standing histories of increasing dividends.

The stocks within this varied model portfolio tend to yield double that of the S&P 500 Index, with each having at least 25 years of ongoing dividend hikes.

This portfolio can be scaled according to investors’ needs, with future income likely to rise through the continued dividend growth of these companies.

By doing so, retirees can benefit from consistent cash flows to meet their requirements.

For those seeking more high-quality dividend-growth stocks for long-term investment, exploring Sure Dividend’s databases is worthwhile.

Major domestic stock indices also provide great resources for finding investment ideas. Sure Dividend frequently updates and compiles these stock market databases:

Thank you for reading. Please forward any feedback, corrections, or questions to [email protected].