Around five years ago, we ventured into our first affiliate partnership, aligning with one of Darrow’s favorite high-fidelity retirement calculators, Pralana Gold, which operates on Excel. Today, after delving deep into Darrow’s thorough analysis of retirement calculators, I’m eager to discuss the latest development from Pralana—Pralana Online. This new version retains its rich set of planning features while offering significant improvements in design and user experience.

What’s New

Pralana Gold was acclaimed for its detailed analysis capabilities, often surpassing those found in many professional financial planning tools I use with clients. While users appreciated the detail, they often disliked its Excel dependency, which required downloads and moving data between devices. Personally, this was why I’d previously shied away from using it extensively. However, Pralana Online addresses these challenges by allowing data storage within your account, easily accessible from any device, and enabling data import from Pralana Gold.

One major critique of Pralana Gold was its overwhelming complexity for some users, though others cherished this depth. Pralana Online still presents a steeper learning curve than other calculators, but the benefits it offers may justify the additional effort, depending on user preferences.

I won’t dive into every feature of Pralana Online here; instead, I’ll share some screenshots to give you a feel of the interface and highlight features I’m most interested in exploring further. If there are specific aspects you’d like examined in future posts, please drop a note in the comments.

Quick Start

For newcomers, starting with the “Quick Start” option is highly recommended. It assists with initial data entry, providing immediate outputs. Similar to other online medium-fidelity calculators, the Quick Start helps avoid overwhelm and allows data to roll over for more detailed modeling later.

Basic Plan Information

Initially, you’ll input personal data like marital status, birth and retirement dates, life expectancy, and in the full program, details about your children for precise tax benefit modeling. You can also input your state of residence to calculate projected state taxes and explore the effects of interstate moves. Here, you enter your inflation rate, with the program offering a default to kickstart customization.

Your Accounts

The next step is entering your account details, allowing you to name, add, or remove them as needed. You’ll assign a rate of return to each, useful if you manage bonds in tax-deferred accounts differently than more aggressively invested Roth accounts. Pralana Online offers default return values for initial setup, expanding into more detailed modeling options beyond Quick Start.

Income and Expenses

Proceed to model income streams with specific start and end dates, growth rates, and savings into retirement accounts. Here, pension and Social Security income details are also inputted, with guidance pop-ups aiding accuracy. The final Quick Start input involves expense entries, allowing variable amounts for different periods.

Pralana Online then analyzes this data to deliver initial outputs, with the full version supporting up to three scenario builds.

Analyze

In the analysis phase, Pralana Online calculates a success percentage for your financial plan and provides a median end-of-plan balance projection. Utilizing both Monte Carlo and historical analyses, it offers a broader data set, including features like spending strategies, Roth conversions, and Social Security optimization.

Building Detailed Financial Models

While Quick Start familiarizes you with basic inputs, Pralana Online truly excels at handling comprehensive financial modeling. This involves updating assumptions on factors like lifespan, investment returns, and inflation, among others. It’s crucial to input accurate data to avoid skewed outputs.

Under the build tab, extensive options to model scenarios involving assets, income streams, and expenses are available.

Checking Your Work

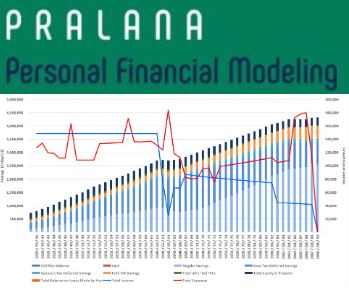

Two years of working with professional planning software has taught me the importance of double-checking inputs to avoid errors. The "Review" tab’s various graphical and tabular options are invaluable for this. You’ll also benefit from visual trends identifying planning opportunities and catching errors in data inputs, like improperly entered Social Security benefits.

Reports

Pralana Online supports diverse report creations, including tax forms like Form 1040, which help match your actual tax forms to check for discrepancies and identify planning opportunities.

Summing Up

Pralana Online stands as a high-fidelity financial tool, potentially exceeding some professional software in capabilities. While it demands an initial investment of time for data collection and understanding outputs, those willing to engage will find it sophisticated and well worth the $119 price tag.

As a disclosure, Pralana is an affiliate partner, and purchases through site links support the blog. This affiliation comes without extra cost to you and represents products we trust and value.

For additional insights or financial planning advice, feel free to reach out.