Ethereum has bounced back to $2,800 over the last day, driven in part by significant withdrawals from exchanges, primarily orchestrated by whale investors.

Ethereum Exchange Outflows Surged Post-Price Dip

Data gathered from IntoTheBlock, a known market intelligence provider, highlights that Ethereum’s recent price decline prompted investors to remove their holdings from exchanges.

Central to this narrative is the "Exchange Netflow" metric. This metric plays a crucial role as it measures the net flow of Ethereum moving in and out of centralized exchange wallets.

When there’s a positive netflow, it suggests that more Ethereum is being deposited into exchanges than withdrawn, often signaling a potential sell-off and negative sentiment for Ethereum’s market value. However, a negative netflow flip indicates that more cryptocurrencies are leaving the exchanges than coming in. This trend typically signals that investors are accumulating, potentially driving up Ethereum’s value.

The following chart depicts Ethereum’s Exchange Netflow trends over the last year:

As shown in the graph, there was a sharp decline in the Netflow yesterday, coinciding with a price plunge of the asset.

In a substantial movement, investors collectively pulled out 350,000 ETH, roughly valued at $982 million based on current rates. IntoTheBlock analysts note that this is the largest net withdrawal from exchanges since January 2024.

The timing suggests that influential whale investors likely seized the opportunity to buy Ethereum at depressed prices post-crash, buoying its recovery and helping establish a price floor.

Moving forward, keeping track of the Exchange Netflow will be crucial as its ongoing trends could impact Ethereum’s pricing trajectory. Sustained outflows could signal bullish momentum, whereas a shift towards more inflows might hint at potential bearish pressure.

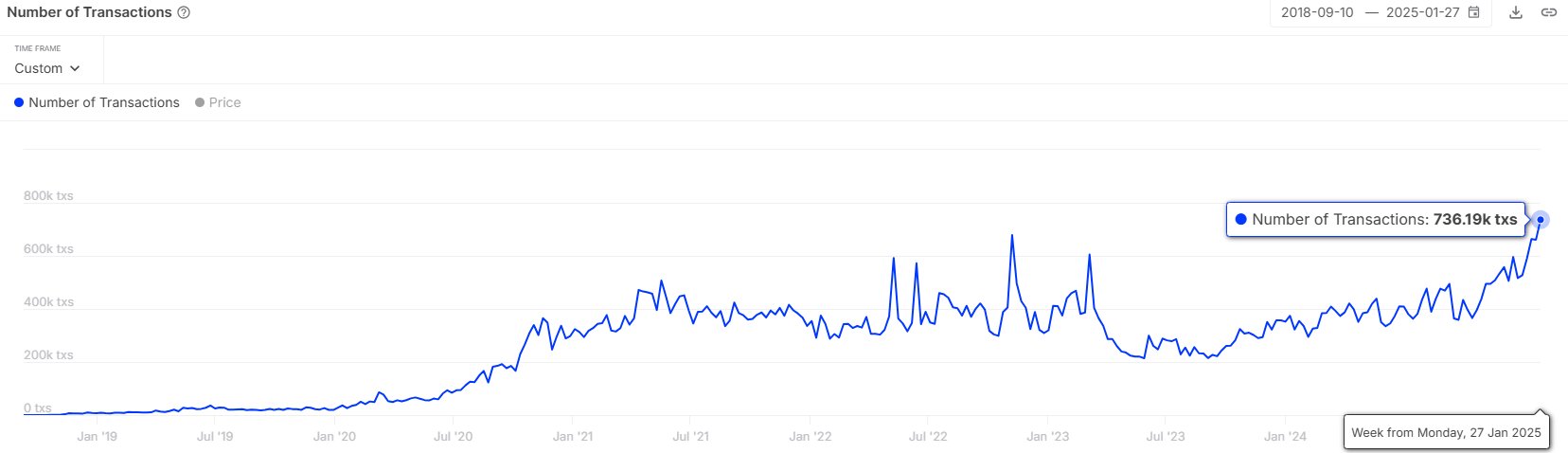

Meanwhile, an interesting development from the stablecoin space sees the USDC, currently the second-largest by market cap, experience a spike in transactions, as reported by IntoTheBlock.

"The surge in daily transactions has exceeded a 119% increase over the past year," the analytics firm revealed. Such heightened activity in stablecoins could provide liquidity and stability, bolstering volatile assets like Ethereum and potentially benefiting the broader market landscape.

ETH Price

Currently, Ethereum’s valuation hovers around $2,800, reflecting a decrease of over 11% over the past week.