Key Takeaways

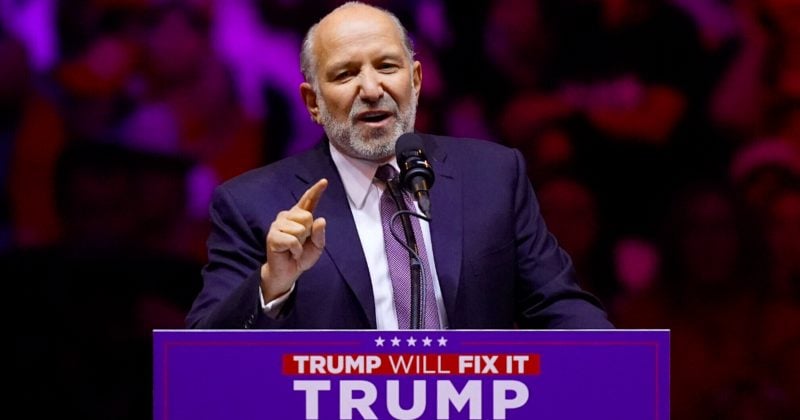

In an intriguing development, Cantor Fitzgerald has moved forward to secure a 5% stake in Tether, amounting to a substantial $600 million deal. Notably, Howard Lutnick, Cantor’s CEO and nominee for Commerce Secretary, announced he would resign once confirmed for the role.

According to a November 23rd piece from the Wall Street Journal, Cantor Fitzgerald, under Lutnick’s leadership, struck this significant acquisition deal. Lutnick, known for his strong support of stablecoins like Tether’s USDT and Circle’s USDC, was recently nominated as the top economic policy figure in the incoming Trump administration.

Reflecting his support for stablecoins, Lutnick stated at the Chainalysis Links conference back in April, “Dollar hegemony is fundamental to the United States of America. It matters to us, to our economy. That’s why I’m a fan of properly backed stablecoins. I’m a fan of Tether. I’m a fan of Circle.”

The financial powerhouse, Cantor Fitzgerald, oversees an impressive volume of U.S. Treasuries, which are integral to backing the USDT stablecoin that’s grown to over $130 billion in market value. Since 2021, this partnership has been strictly business-focused, honing in on reserve management rather than exerting any regulatory clout, as Tether clarified prior to Lutnick’s nomination.

Quashing any assumptions about regulatory influence, Tether’s spokesperson remarked, “The claim that Lutnick’s involvement in a transition team somehow translates into influence over regulatory actions is laughable.”

Lutnick has indicated he’ll step down from his role at Cantor once the Senate confirms his new appointment and plans to divest his interests to comply with government ethics requirements.

On another note, Tether has faced scrutiny over possible breaches of money laundering and sanctions laws, the Wall Street Journal highlighted last month. The investigation is reportedly looking into whether the USDT stablecoin has been employed by third parties to finance unlawful operations.

However, Tether has pushed back against these accusations, dismissing them as “outrageous” and asserting that such claims are merely speculative without any solid basis. Paolo Ardoino, the CEO, dismissed the reports as nothing more than “old noise.”