Today’s focus zeros in on Florida’s spiraling home insurance market – a subject that’s causing distress for residents as premiums soar to unprecedented levels.

In 2024, Floridians faced an average annual homeowner’s insurance premium close to $11,000, making it the priciest in the nation.

You might guess this spike is all down to Florida’s frequent hurricanes. Indeed, three hurricanes have crashed onto its shores this year alone, equaling a record for the most in a single season.

Figure: Hurricane Milton slams into Florida on October 10, causing 35 deaths and around $85 billion in damages. Credit: US Space Force

Yet, hurricanes tell only part of the tale.

A significant chunk of this issue traces back to human missteps. Ill-conceived regulations are leaving homeowners with hefty bills, while insurance firms find it tough to profit.

However, thanks to recent legal reforms, there might be a glimmer of hope for Florida’s insurance landscape, hinting at potential gains for companies within this sphere.

In today’s analysis, we’ll cover:

- Why hurricanes aren’t the sole culprits behind this predicament

- How Florida shoulders 75% of the home insurance lawsuits in the US

- The way well-intentioned measures amplified the crisis

- How you might benefit from the forthcoming revival of Florida’s insurance scene

Note: Dive into the first half at no cost. But for the full picture, you’ll need an All-Access Pass.

Let’s explore 👇

Brian Flaherty started investing at 15, picking his first mutual fund. After earning an Economics degree from UVA, he began guiding high-net-worth clients at a wealth management firm. Now, Brian scouts for top investment opportunities. He has shared insights on investing in Silver, Uranium, and Lombard Loans. Catch him on LinkedIn.

This Goes Beyond Hurricanes

It seems logical to pin Florida’s sky-high property insurance costs on hurricanes.

Figure: Florida experiences more hurricanes than any other US state. Only 18 seasons missed a hurricane since 1851. Source: NASA

Sure, the threat of hurricanes does contribute to these remarkable insurance premiums, and with climate change, the threat amplifies.

Yet, if hurricanes were the whole picture, wouldn’t neighboring states face similar costs? Storms, after all, don’t halt at state lines.

That’s not the case. Home insurance for a $300k property costs about $2,400 annually in Alabama and Georgia—just slightly above the national mean.

In Florida, homeowners are forking over approximately $5,500 for a $300k house, double the amount their neighbors pay.

Since 1980, Alabama and Georgia have actually contended with more billion-dollar weather events than Florida.

Despite Florida’s hurricanes, it’s not the outlier you’d predict when considering weather-related risks.

Federal aid allocations post-disaster tell an interesting story too. States like New York, Arkansas, and North Dakota surpass Florida in per capita disaster assistance from 2011 to 2023.

Yet, these states have significantly lower property insurance premiums.

Figure: Major disaster declarations in US counties from 2011-2023. Florida isn’t alone in facing extreme weather challenges. Source: Rebuild by Design

It’s Not Just About Profit Greed

Some argue that Florida’s high insurance rates are fueled by company executives eager for greater profits.

But consider how many insurers are opting out of the state voluntarily.

In 2023, notable companies like Farmers, AAA, and Lexington Insurance (part of AIG) withdrew from Florida’s insurance scene.

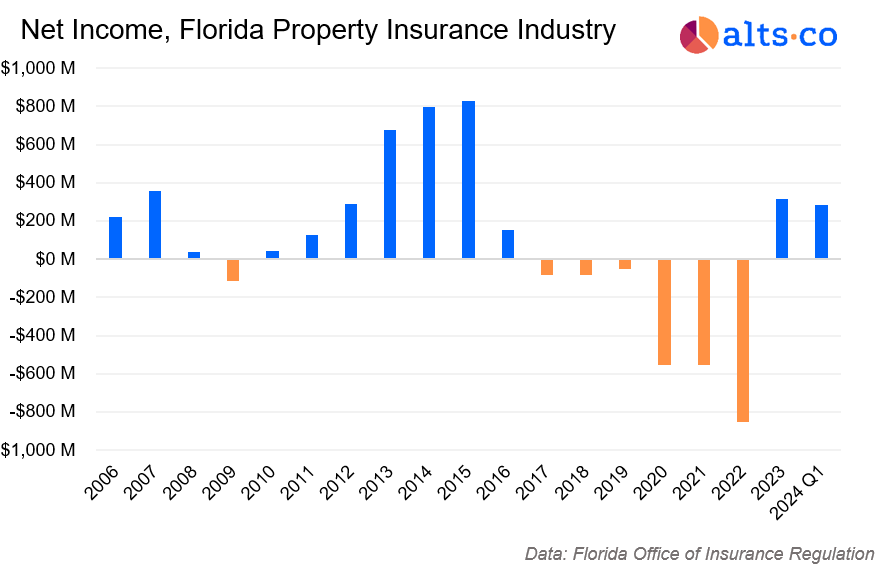

Before 2023, Florida’s insurance companies hadn’t seen profits for six consecutive years!

From 2021 to 2022, seven local insurers even went belly up.

Sure, poor management decisions and ill-conceived dividends haven’t helped, but if corporate greed was the main issue, profitability would be much more evident—and it isn’t.

Florida’s Legal Quagmire

If hurricanes and corporate strategies aren’t to blame for Florida’s staggering insurance premiums, what is?

The answer might surprise—it’s insurance litigation.

Post-claim litigation remains a complex and misunderstood facet of the insurance world, yet it plays a key role:

- Someone files a claim with their insurer.

- The insurer denies it.

- The policyholder sues to collect their due.

- Insurers either face the courts or settle.

When it comes to homeowners’ insurance litigation, Florida is in the lead. 👑

In 2022, the state:

- Represented 6.5% of the US population.

- Filed 15% of the US homeowner claims.

- Was responsible for 71% of the nation’s homeowner insurance lawsuits!

In 2022, nearly three-quarters of all homeowner insurance lawsuits in the country originated from Florida.

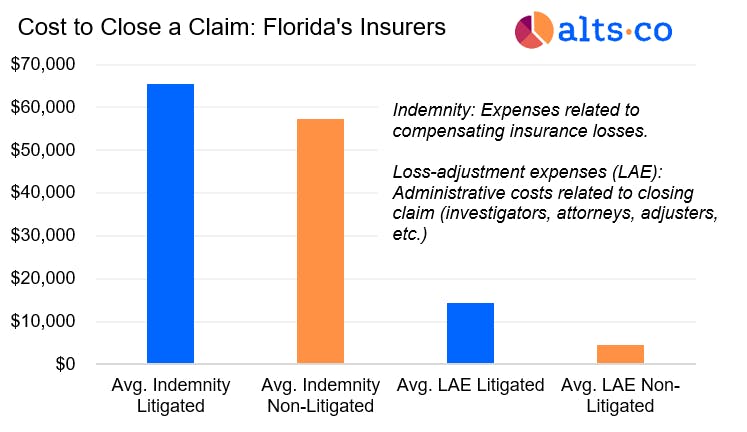

As a consequence, Florida insurers spent close to $3 billion on these legal battles, usually settling to avoid protracted court battles.

That year, the state’s insurers reported net income losses amounting to $854 million.

This marked the sixth year of consecutive losses for the industry, with hurricanes missing in the equation during three of those years!

Figure: Handling litigated claims in Florida incurs notably higher costs in indemnity and legal expenses. Source: Florida Office of Insurance Regulation

Insurance litigation rules are designed to enforce fair claim settlements, preventing insurers from dismissing claims without grounds.

But instead, the landscape has become skewed, encouraging individuals to sue and insurers to settle quickly.

The Citizens Conundrum

High property insurance rates in Florida aren’t a new problem, yet past solutions often made matters worse.

Take Citizens Property Insurance Corporation as a prime example.

Following Hurricane Andrew’s devastation in 1992, some Floridians couldn’t secure home insurance at any cost.

In response, the government initiated two state-backed non-profits to bridge this gap, which merged in 2002 to form Citizens.

Originally, Citizens was meant to safeguard only a small fraction of Floridians who couldn’t find coverage otherwise.

Yet, it’s grown to become a primary insurer for many in the state!

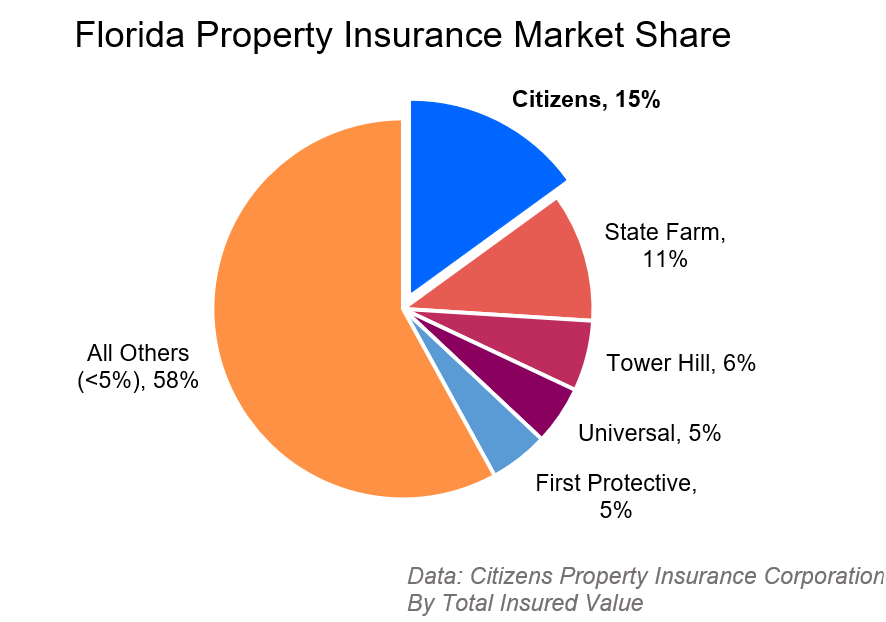

Citizens now accounts for 16% of policies and 15% of the insured dollar value in Florida, dominating the market.

Floridians qualify for Citizens if:

- They’re unable to find coverage elsewhere.

- Private insurance quotes are over 20% higher.

Effectively, Citizens undercuts private market rates, creating a short-term relief measure that sidesteps addressing core problems.

It’s no wonder Citizens captures an ever-expanding slice of the market as private rates continue to soar.

Moreover, Citizens, as a state-endorsed entity, can maintain lower rates with unique avenues to cover possible shortfalls.

For example, if Citizens runs low on funds, it imposes a 10% surcharge across all state policyholders, raising funds to bridge gaps.

Thus, both Citizens’ and private-market policyholders could see consistent annual hikes to shore up financial reserves.

The surcharge could extend beyond homeowner’s insurance, affecting renters, auto, boat, or even pet insurance policies if needed.

A Glimmer of Hope: Market Reforms

Beset by litigation costs and competing with state-backed insurance, Florida’s insurers have struggled.

Yet, there seems to be light at the end of the tunnel.

In 2023, the state’s domestic insurers finally posted profits—breaking a long losing streak since 2016!

This rejuvenation seemingly links to subtler adjustments in Florida’s insurance litigation statutes.

Consequently, Florida’s insurance firms now appear more enticing as investment prospects.

Unlock the full journey:

- Discover the recent changes in insurance litigation laws and their implications.

- Understand how Florida’s market is showing signs of recovery.

- Consider four companies worthy of investment.

Explore this in full detail by unlocking the complete issue here 📈