(Bloomberg) — As the final trading days of 2024 unfold, US stock futures are taking a hit, mainly due to a faltering surge in tech shares.

The ripple effect was evident as S&P 500 and Nasdaq 100 contracts slid around 1%, hinting at another dip on Wall Street following Friday’s downturn, propelled by a pullback in major tech stocks. In Europe, the Stoxx 600 index took a step back, and Asian markets broke their five-day winning streak. Holiday festivities contributed to lighter trade volumes.

This year, a group of leading US tech firms, known as the "Magnificent Seven," has been pivotal in driving the S&P 500 up by 25%. However, there are concerns that the rally’s benefits are clustered in just a few companies. Despite this, nobody among the 19 strategists Bloomberg tracks is predicting a decline for the S&P 500 in the coming year.

“In times like these, staying the course seems wise,” suggested Nicolas Domont, a fund manager at Optigestion in Paris. “The US is still the place to be. Growth stocks are excelling, and earnings projections are favorable, so the outlook remains positive.”

On the bond front, Treasuries gained as 10-year yields dipped from their highest levels since May. Meanwhile, the euro gained strength and German bonds lost earlier gains after new data revealed that Spain’s inflation rose more than expected. This bolstered the argument for the European Central Bank to slowly cut interest rates.

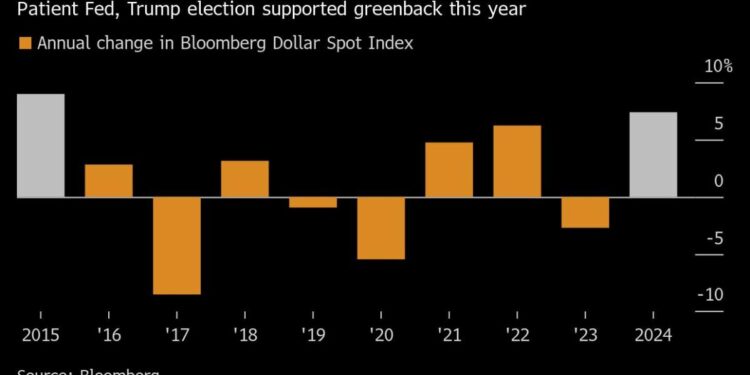

The Bloomberg Dollar Spot Index hovered within a narrow band after climbing over 7% this year, buoyed by expectations tied to President-elect Donald Trump’s “America First” policies.

“There’s some unease as we approach year-end, partially due to uncertainty about international trade’s future in 2025,” noted Tim Waterer, chief market analyst at Kohle Capital Markets Pty. “Many traders are dialing back risks as the year wraps up.”

Trading in Europe’s main equity benchmark was about half of its usual 30-day average. For certain European markets, like Germany, this marks the last session of 2024. Germany’s DAX benchmark is poised to end the year with a 19% gain, outpacing counterparts in the UK and France.

Tragedy struck in Asia where Jeju Air’s share prices plummeted 8.7% in Seoul, reaching an all-time low. This came after a Boeing Co. 737-800 jet operated by the airline crashed on Sunday, claiming nearly all 181 lives aboard. Boeing shares slipped as much as 5.1% in US premarket trading before recovering somewhat. Investigators are currently examining potential causes like a bird strike or a landing-gear issue, though it appears unrelated to Boeing’s production. Boeing reaffirmed its commitment to support Jeju Air during this time.

As the end-of-year market winds down, crude oil remains largely unchanged, with the focus now shifting toward 2025. While oil prices stagnate, gold is poised for one of its most significant annual gains this century.

On a somber note, former US President Jimmy Carter passed away Sunday at his home in Plains, Georgia. It is customary for US stock markets to close for presidential funerals, but no confirmations have been announced by exchange officials yet.

This week’s highlights include:

- China’s manufacturing and non-manufacturing PMI reports on Tuesday.

- New Year’s Day celebrations on Wednesday.

- US construction spending, jobless claims, and manufacturing PMI data on Thursday.

- US ISM manufacturing and light vehicle sales figures on Friday.

Recent moves in various markets are:

Stocks:

- S&P 500 futures down 1% as of 8:27 a.m. in New York.

- Nasdaq 100 futures also fell 1%.

- Dow Jones Industrial Average futures dipped by 0.8%.

- The Stoxx Europe 600 declined 0.4%.

- MSCI World Index held steady.

Currencies:

- The Bloomberg Dollar Spot Index remained stable.

- The euro edged up 0.1% to $1.0437.

- The British pound held firm at $1.2587.

- The Japanese yen rose 0.2%, settling at 157.60 per dollar.

Cryptocurrencies:

- Bitcoin saw little change, maintaining at $93,115.78.

- Ether rose 0.5% to $3,361.21.

Bonds:

- The yield on 10-year Treasuries fell five basis points to 4.57%.

- Germany’s 10-year yield dropped two basis points to 2.38%.

- Britain’s 10-year yield decreased by two basis points to 4.61%.

This article was written with help from Bloomberg Automation and Aya Wagatsuma.