Welcome once again to this little space where, for the next eight to ten minutes each week, you’re cordially invited into my world.

In our previous chat, we ventured out of my usual realm to speculate on the repercussions if DJT decides to limit the Fed’s power. I know, quite the leap from our usual topics, and while there are certainly some cracks to slip investment opportunities into, the general sentiment seems that it’s not the wisest path to tread.

This time around, we’re diving into more arcane subjects. Ever heard of horse pinhooking? Or wondered if the wine industry’s had one too many? And who knew there was a saga unfolding in the Armenian cognac world? Stick around as I share some things that caught my fancy this week.

Take a look and share your thoughts. Ready? Let’s jump in.

WTF is horse pinhooking?

So, picture this: Altea, our exclusive club for alternative investors, has brought in someone rather intriguing—a lawyer by day, who moonlights as a fund manager in the world of horse pinhooking. Like you, I’d never come across the term before, and now I’m utterly fascinated.

Horse pinhooking revolves around the idea of purchasing a foal, essentially a baby horse under a year old, and selling it off as a yearling, when it’s between one to two years old. The crux of the strategy is doing everything possible to boost the horse’s value in the interim.

The difference in price from a foal to a yearling can be staggering, creating a niche yet lucrative avenue for savvy investors.

Why such a price shift, you ask? It all boils down to timing, risk, and growth.

Foals are bundles of potential—adorable yet unpredictable. Buyers at this stage play a guessing game, not knowing what form the foals will take or if they’ll even reach maturity. It’s a bit like investing in an idea rather than a tangible product. Around 15% don’t even make it to auction due to various misfortunes.

On the flip side, yearlings bring assurance. As they reach their first birthday, their physical possibilities become clearer. Potential buyers can assess their build, coordination, and demeanor, making educated bets on future performance. It’s akin to backing a startup that’s launched and gained traction, as opposed to one that’s just pitching an idea.

The market buzz can amplify if the horse’s bloodline wins significant races, gaining its lineage some prestige. The better handled these yearlings are, the easier they will be for future training, which adds to their appeal.

There are key strategies a seasoned pinhooker can apply during this crucial timeframe, such as:

Nutrition and Growth Optimization

A foal fed with a top-tier diet is bound to grow stronger, showcasing healthy muscles and a robust bone structure. Supplements for joint health, coat shine, and vitality can make them more attractive in the eyes of potential customers.

Handling and Basic Training

Early interaction is vital to ensure the horse is comfortable with humans and obedient. Basic commands and gentle grooming prepare them for the buyer’s demands.

Conditioning and Presentation

While rigorous exercise isn’t necessary, supervised playtime can enhance muscle development and coordination. Gentle exercises can help a yearling have a compelling athletic appearance.

Veterinary and Farrier Care

Regular health checks nip problems in the bud, from treating infections to ensuring proper hoof growth. This preventive measure keeps them in top shape and ready for future training or performance.

Pedigree Updates and Marketing

Staying updated with the foal’s lineage progress is key. Successes within the family tree can draw in high-quality buyers, especially when presented with professional photos and marketing materials.

Auction Preparation

As the foal matures into a yearling, preparing it for sale is paramount, covering grooming, training to walk with poise, and showcasing its capabilities.

Safe and Enriching Environment

Providing a stress-free environment drastically reduces risk, with well-maintained paddocks and consistent routines giving them a stable upbringing.

So, what’s the financial allure in all this?

Investments in horse bloodstock are typically lucrative, with returns from 10% to 25% IRR, and exemplary funds even hitting the 30% annually over three to five years. Yet, some funds do experience downturns or even negative returns when the market sours or horses don’t perform as expected.

The deal under Altea promises notably higher returns in a shorter than usual timeline, making it worth observing closely. We’re planning a due diligence trip to an auction soon, which might clear up some mysteries surrounding this business. If you’re interested in tagging along or just staying in the loop, let us know here.

Is the wine industry drunk?

Meanwhile, the wine world is tackling quite a hangover. In France, a global heavyweight in wine production, there’s a staggering surplus that’s led the government to buy back €120 million ($130 million) worth of excess product and turn it into industrial alcohol for things like hand sanitizer and parfum. In fact, around 400 million bottles are going this route.

Moreover, French winemakers are calling it quits with their vines. In Bordeaux, which is synonymous with high-end wines, winemakers are uprooting nearly 23,500 acres of vineyards—a sweeping move that’s not confined to France. Spain is following suit.

What’s causing this epic grape crisis? A perfect storm:

Changing Consumer Tastes

Wine drinking in France has nosedived from 120 liters per person back in the ’60s to just 40 liters today, with newer generations opting for craft beers, cocktails, and even non-alcoholic choices. Over the last decade, red wine sales in France have slipped by 32%.

Market Oversaturation

Europe is overflowing with wine, France, Italy, and Spain alone account for about 47% of the world’s output. Yet, as production chugs along, demand wanes. While Italy and Spain saw wine production drop by over 20% in 2023 alone, there’s still a glut.

Climate Change

Erratic weather patterns are disrupting grape quality and harvest times. In 2023, wine production worldwide fell by roughly 9.6% due to such climate impacts, pushing vintners to harvest earlier than planned, which can compromise wine quality.

Economic Pressures

Rising costs and inflation have nudged consumers to trim spending on non-essentials like wine. Consumption dropped in Spain, Germany, and Portugal. Restaurants and trade events, key sectors for wine sales, are still reeling from pandemic aftershocks.

From an investment lens, the scene doesn’t look rosier. The Cult Wine Investment Performance Index saw a 2.29% decline in Q3 2024, with Bordeaux being the hardest hit at a 4.40% dip. Even Burgundy, typically a steady performer, wasn’t spared, posting a small decline.

What’s worrying is that this scenario hints at a deeper, long-term issue rather than a mere hiccup. The classic model of wine consumption—regularly enjoying a bottle with meals—is waning. The massive drop in French wine consumption over the decades signifies a seismic shift in behavior.

In regions like Bordeaux and Languedoc, the grim reality is dawning on producers, as they resort to selling wine for less than it costs to produce. As the head of Languedoc Wine Producers’ Association bluntly comments, they’re making too much wine that they cannot sell at sustainable prices.

Is there hope amid this crisis? Maybe. This predicament might force the industry toward needed modernization. Some producers are shifting focus to whites and rosés, growing favorites among the younger crowd. Others are eyeing lower-alcohol products and sustainable practices to attract the health-conscious.

But at present, the wine sector appears suspended between honoring its rich history and navigating an uncertain future. It’s not just a matter of whether the glass is half full or half empty – it’s whether anyone desires its contents at all.

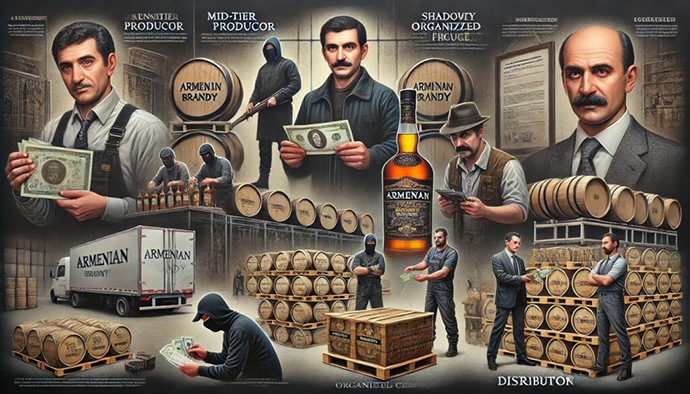

Meanwhile, in the world of Armenian cognac

In a rather intriguing twist, if you’ve ever toasted with what you believed was genuine Armenian cognac, you might want to think again. It’s now come to light that a huge chunk—up to 90%—of what’s sold in Russia (the main export hub) isn’t what it seems; many of these Armenian brandy bottles are downright fakes.

The investigation uncovers a scandal of epic proportions involving shady operations, dubious individuals, and impressive profits, casting a long shadow over an otherwise esteemed industry.

Allow me to break it down on how such deceptive practices unfold, the masterminds at work, and the sheer numbers involved.

How It’s Done: The Step-by-Step Playbook

Production

The counterfeiting begins with mid-tier legitimate producers moonlighting as fake product manufacturers after hours. Genuine brandy rolls out during the day but nightfall ushers in less authentic efforts.

The Process: Industrial alcohol is cleverly doctored with flavory additives and water to simulate real brandy attributes, topped off with quick-maturing agents. A counterfeit bottle merely runs $3-$4 compared to the $8-$10 it takes for a genuine one.

The Cover: Genuine facilities disguise fake products among authentic shipments adding a shred of legitimacy.

Packaging

Craftily recreating packaging is imperative to sell counterfeit as authentic.

The Tactics: They use reused bottles and professionally replicated labels, often indistinguishable from the real deal.

The Cost: All packaging per bottle is achieved at approximately $1.

Documentation

Counterfeit goods are slipped into the market disguised as legitimate through forged documents.

The Strategy: Fake transport and export documentation smooth the passage of these goods.

The Cost: Forging papers costs $5,000-$10,000 per shipment, a pittance compared to the riches gained.

Distribution

The fraudulent goods travel through multiple borders, heavily relying on bribes and semi-legal transportation setups.

The Cost: Handling transport is typically between $8,000 and $14,000 per truckload of 1,000 cases.

The Network: Russian and nearby regional warehouses efficiently distribute products.

Who’s Behind It: The Shadow Players

Producers

Some mid-level industry players run the production. Under financial duress, they resort to counterfeiting to bolster their financial gain.

Annual Earnings: Between $2 million and $5 million from phony production.

Criminal Facilitators

These are the customs handlers, quality inspectors, and transit businesses ensuring smooth operations.

Bribes Earned: Annually ranging from $100,000 to $500,000 for each corrupt player.

Distributors

Somewhat legitimate importers, often mixing fake with real, funnel counterfeit goods into Russia’s market.

Annual Profit: $1 to $3 million per network.

Protection Rackets

Organized crime syndicates keep the gears of this operation well-oiled, covering everything from security to bribing.

Annual Earnings: $2 to $4 million per group.

The Financials: Big Bucks, Low Risks

The magnitude of this entire scheme is immense and shockingly profitable. Here’s a peek into the math:

Per Case (24 Bottles) Profit Margins

- Production Costs: $120-$156 per case

- Distribution Costs: $60-$85 per case

- Wholesale Price: $360-$480 per case

- Profit Per Case:

- Producer: $108-$192

- Distributor: $72-$120

- Retailer: $54-$96

Annual Market Value

- Legitimate Armenian Brandy Exports: $180 million

- Counterfeit Market Value: Estimated to be $800 million

- Total Illegal Profits: Roughly $500 million distributed among producers, facilitators, distributors, and crime syndicates.

Why It Works: A Perfect Storm of Opportunity

Systemic corruption coupled with an eager market for low-cost Armenian brandy has created fertile grounds for counterfeiters. The corruption within customs and regulatory bodies ensures product movement remains inconspicuous. Coupled with lax enforcement and international trade loopholes, the charade continues unchecked.

This isn’t your average financial scandal, as it poses a serious threat to the brandy industry. By flooding the market with imitations, the credibility of Armenian brandy is at stake, potentially destabilizing a product vital to nearly 9% of Armenia’s exports. Continued duplicity could endanger a major segment of their economy.

It’s a billion-dollar juggernaut built on deceit and corruption with low risks but high rewards for those involved. For consumers, it’s a reminder to be wary—what’s gleaming on the shelves might not be gold, or in this case, brandy.

Things I love this week

Now, let’s end things on a lighter note with some fascinating, albeit high-priced, treasures that may catch your eye.

Star Wars Prototype Rocket-Firing Boba Fett L-Slot / Hand-Painted Alternate Paint Scheme AFA 80 NM (Kenner, 1979)

It’s a blast from the past! These rare Boba Fett figures were pulled due to safety concerns and regularly fetch six-figure sums. There’s an even rarer version ending soon at Hake’s.

Star Wars Boba Fett 21 Back A AFA 85+

For those whose wallets don’t stretch to the lethal prototype, Heritage’s offering of this iconic non-launching version is a much more economical alternative.

Michael Jackson Stage Worn Crystal-Studded Glove from the Victory Tour

Picture this sparkling glove on your hand, once part of Michael’s unforgettable Victory Tour in 1984. It’s a real collector’s dream!

Prince’s Personally-Owned and -Played Blue Schecter ‘Cloud’ Electric Guitar

Over at RR Auction, you’ll find this legendary guitar used by Prince himself for practice before live shows.

The Beatles | George Harrison Futurama Hamburg and Cavern club Guitar

At Julien’s Auctions, those dreaming big can bid for this historic guitar, which was central to the early Beatles’ sound from the late ’50s to early ’60s.

And with that, we’ve reached the end for this week. Hope you enjoyed the dive into intriguing waters. Until next time, cheers!

All the best,

Wyatt

Disclosures: