Life is never short of questions and choices, and the answers aren’t always straightforward. Should you buy a house or stick to renting? Start a family, switch careers, or perhaps prepare for an early retirement? These aren’t decisions to rush into, as each is intertwined and plays a crucial role in shaping your financial future.

Traditional financial planning tools often zero in on one objective: retirement. They might suggest a savings target or estimate when you can retire. But let’s face it—real life is far more nuanced. It involves a series of milestones and decisions, each with its own set of trade-offs and opportunities. That’s why we developed ProjectionLab.

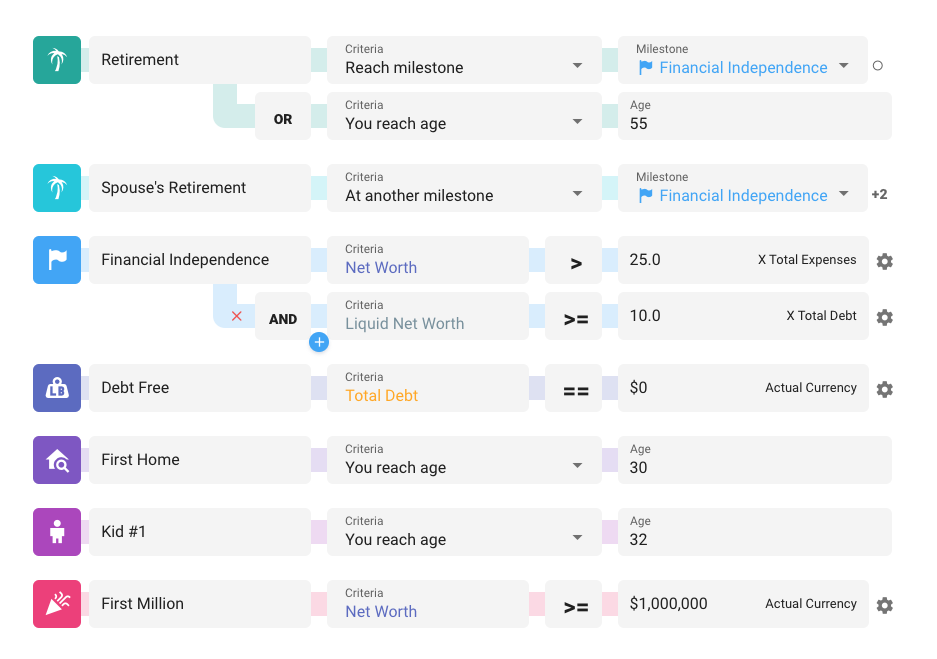

ProjectionLab isn’t your average retirement calculator. It’s designed to tackle life’s tough "what-if" questions. Whether you’re considering a career change, starting a family, or just figuring out your next move, ProjectionLab allows you to model different scenarios and see how they fit into the grand scheme.

Why Choose ProjectionLab?

Here’s what sets ProjectionLab apart:

- Adaptable to Every Stage: Life evolves, and so do your priorities. ProjectionLab enables you to adjust your plan for where you are today and where you want to be tomorrow.

- Flexibility for Real-Life Decisions: Beyond just retirement, you can model housing, careers, family, and major expenditures, making informed decisions with confidence.

- A Complete Financial Picture: Each scenario doesn’t just impact your savings—it affects your net worth, cash flow, taxes, and long-term financial goals.

Let’s dive into a few ways ProjectionLab can help you plan for the moments that matter most.

Planning for Life’s Big Milestones

Life’s rewards often come with financial responsibilities. Whether you’re starting a family, supporting loved ones, or celebrating major events, ProjectionLab keeps you ahead of the curve.

- Having Kids vs. Not Having Kids: Weigh the costs of raising children against other life goals, like early retirement or travel.

- Childcare and Education Costs: Plan for daycare, private school, or college tuition, and understand how these fit into your overall financial picture.

- Supporting Aging Parents: Consider how providing financial assistance or caregiving impacts your long-term goals.

- Saving for Major Events: Budget for major milestones like weddings or milestone birthdays without compromising financial health.

Navigating Career Transitions

Career choices significantly impact your financial path, whether it’s a job change, sabbatical, early retirement, or a complete career shift. ProjectionLab helps you navigate these transitions.

- Going Part-Time or Taking a Sabbatical: Understand how reducing work hours affects your savings and financial goals.

- Changing Careers or Job Loss: Evaluate how a new career path or unemployment might alter your financial future.

- Planning for Early Retirement (FIRE): Chart your course to financial independence and determine how soon you can leave the traditional work life.

- Transitioning from a Side Hustle to Full-Time Business: Assess if your passion project can sustain your lifestyle.

Making Smart Housing Decisions

Housing is one of the most significant financial decisions. Whether you decide to buy, rent, or invest, ProjectionLab aids in making informed choices.

- Rent vs. Buy: Analyze whether it’s wiser to rent or commit to homeownership by comparing the financial pros and cons.

- Relocating: Moving to a new city? Check out how living costs might affect your finances.

- Becoming a Landlord: Interested in rental income? Model potential earnings and costs of being a landlord.

- Renovations or Upgrades: Plan for home improvements and their impact on your financial strategy.

Optimizing for Retirement and Taxes

Retirement planning isn’t just about saving—it’s about optimizing your assets. ProjectionLab helps you refine your retirement strategy.

- Roth Conversions: Discover how converting retirement funds affects your tax strategy and future income.

- Withdrawal Strategies: Experiment with different methods to draw down your savings for optimal income.

- Tax Projections and Monte Carlo Simulations: Gain clarity on tax obligations and test your chance of achieving financial success.

- Budget for Your Retirement Lifestyle: Plan for hobbies, travel, or leisure activities in retirement.

Health, Lifestyle, and the Unexpected

Health and lifestyle choices can have lasting financial effects. ProjectionLab prepares you for the life you envision, even when surprises occur.

- Healthcare Costs: Plan for medical expenses, from routine care to long-term care needs.

- Taking Time Off for Health Reasons: Whether taking a medical leave or prioritizing self-care, see how it fits financially.

- Enjoying Life More Now: Want to indulge more in hobbies or travel? Examine how this impacts future goals.

- Longevity Planning: Ensure your finances last as long as you do.

Tackling Debt and Big Purchases

Managing debt or saving for significant expenses? ProjectionLab has you covered.

- Paying Off Debt Early: See how early repayment of student loans, credit cards, or a mortgage could save money and improve your future cash flow.

- Planning for Major Purchases: Whether buying an RV or taking a dream vacation, budget without hindering financial progress.

- Vehicle Replacement: Need frequent vehicle upgrades? Prepare financially to avoid surprises.

Plan for the Life You Want, With Confidence

Life doesn’t always go as planned, but that doesn’t mean you can’t be ready. With ProjectionLab, you get more than just a retirement tool—you gain a comprehensive financial roadmap tailored to your life.

Whether you’re starting a family, changing careers, or planning for early retirement, ProjectionLab equips you with the tools to confidently forge your path.

Your turn has come. Begin exploring your financial future today.